By Mike D’Avolio

According to the Small Business Optimism survey, taxes are currently the number one issue facing small businesses. To help you better prepare and avoid last-minute compliance headaches, here are five must-know tips for small business owners heading into the tax season.

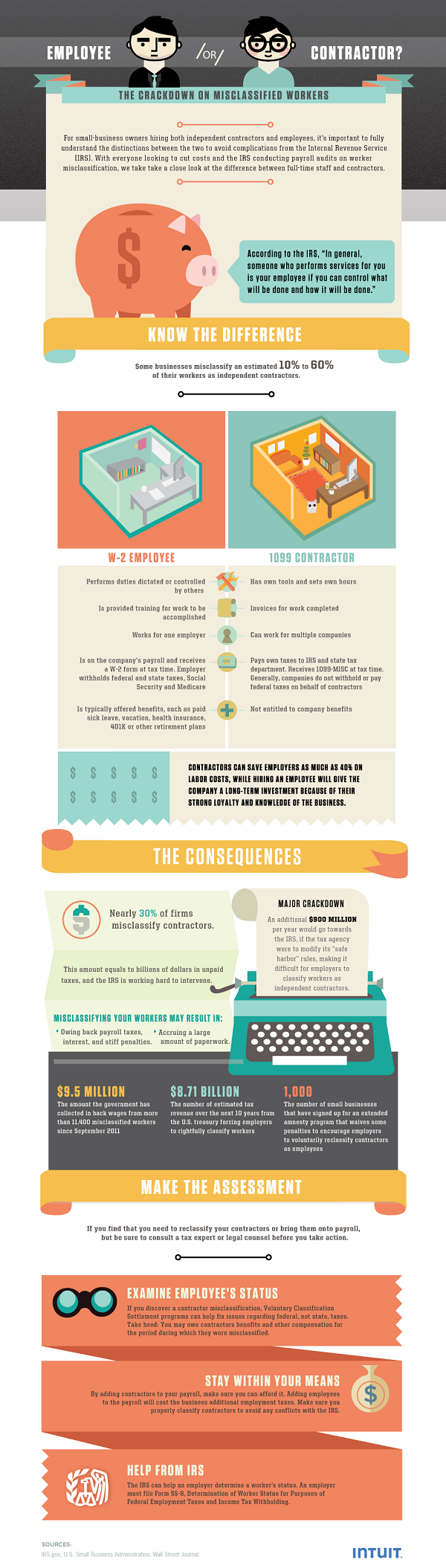

1. Properly classify workers as employees vs. independent contractors

It may be tempting to classify an employee as an independent contractor because of the cost savings. However, there are strict rules around the proper classification of a worker and steep penalties for failing to apply the law correctly. Use the infographic below to help you distinguish between the two.

2. Deductible expenses

You’re allowed to deduct the costs of running your business, as long as the expenses are ordinary and necessary. If you have an item that is used for both business and personal purposes, you can allocate the expense and deduct the business portion – just be sure to document everything and retain any receipts. Assets must be depreciated, or deducted, over the course of their useful life if it extends beyond a year.

3. Retirement plans

Contributions you make for yourself and for your employees can be deducted, and the earnings on those contributions grow tax-free until the money is distributed. In general, contributions to these retirement plans can be made up until the due date of the tax return, which means you can invest money in a plan after year-end and still take a deduction on your 2014 tax return, the one you file in 2015. You’re also allowed a tax credit equal to 50% of the first $1,000 incurred starting a retirement plan.

4. Home office deduction

The IRS now provides a simple way to calculate the deduction associated with using your home for business. It does not, however, change the criteria for who may claim the deduction. Just remember that a portion of the home must still be used exclusively and on a regular basis for business purposes.

5. Start-up expenses

The government encourages people to open a new business by allowing a $5,000 write-off for start-up expenses. Start-up costs include amounts paid to create a trade or business or to investigate the creation or acquisition of a trade or business. Examples include advertising the opening of a business; employee training; and a market survey.

Mike D’Avolio, CPA, is Senior Tax Analyst with the Intuit Professional Tax Group. Mike has been a small business tax expert for more than 20 years and serves as the primary liaison with the Internal Revenue Service for tax law interpretation matters, manages all technical tax information, and supports Tax Development and other groups by providing them with current tax law developments, analysis of tax legislation and in-depth product testing. @IntuitAccts