In honor of Small Business Week, we’re bringing you three bonus editions of Things Entrepreneurs Need to Know. Be sure to check the regularly scheduled column, which posts here almost every Saturday.

By Rieva Lesonsky

1. State of Startup: 2015

Gallup, the research and polling organization, forecasts more than 400,000 businesses will launch this year. Sage just released a State of the Startup 2015 report highlighting the differences—and similarities of startup entrepreneurs.

I talked to Connie Certussi, an EVP and General Manager at Sage who shared some key findings from the report:

- Women are 33 percent more likely to found startups than men.

- 30-50-year-olds overwhelmingly dominate the playing field, founding more than half of all new businesses.

- 99 percent of the business owners graduated from high school & 70 percent had at least a two-year college degree

- California, Florida and New York (and Toronto in Canada) were the most common startup locations

- Most of the founders had no prior startup experience

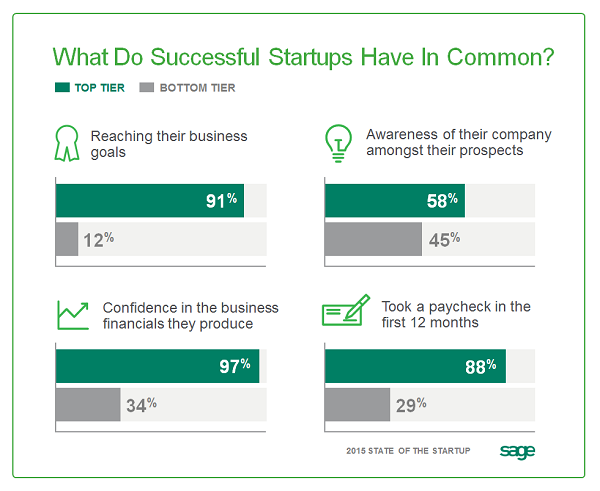

Sage looked at the top-tier entrepreneurs and found there were some valuable lessons for all startup founders on how to succeed:

- Take on a partner. Top-tier startups were 59 percent more likely to have more than one founder.

- Don’t skip the business plan. The most successful founders were 78 percent more likely to have created a formal business plan before launching their new business. As Yogi Berra famously said, “If you don’t know where you’re going, you might not get there.”

- Enlist the help of professional advisors. The best startups lean on the wisdom and experience of trusted advisors such as accountants and mentors. For example, 54 percent of top-tier founders are more likely to hire an accountant, at least part time.

- Embrace the latest marketing tactics. Today’s top entrepreneurs are masters of websites, social media, forums, and all the latest marketing tactics. This is an area where Millennials have a distinct advantage.

- BALANCE! Surprisingly, the most successful entrepreneurs were 58 percent more likely to report they commit themselves to family, friends, and personal pursuits.

In addition to talking to founders, Sage talked to “nurturers,” third parties such as venture capitalists, angel investors, accountants, and attorneys. They say new businesses often struggle with the same three things: growing revenue, adding customers and producing accurate financials. On the accounting question, 36 percent of nurturers say they have a somewhat to extremely low trust of the financials they receive from entrepreneurs. (Which isn’t good if you’re trying to raise money.)

According to the nurturers, the top three mistakes founders make are taking on too much debt, not performing enough market research ahead of time and not controlling costs closely enough. And they thought the entrepreneurs were least prepared to deal with employee and HR issues, the technical aspects of their products or services and marketing.

Sage came up with a list of recommendations for startup entrepreneurs:

- Do not let the fact you may not have experience in starting a business or running a team at a large company discourage you and prevent you from trying. Not only did most of our survey respondents have no prior startup experience, but neither did their parents.

- Don’t wing it, have a plan. One of the first steps for a significant majority of successful entrepreneurs was to create a formal business plan. Doing so helps answer questions you may have for yourself and even come up with new ones you haven’t thought of yet. A business plan is also an absolute requirement if you plan to approach a bank, a venture capitalist or any other potential funding sources.

- Do your research. Conduct a thorough market analysis: Who are your target customers, your competitors? What trends can you take advantage of? This information can help you set specific objectives that you want to achieve over the course of the first year.

- Hire a trusted advisor. To succeed, you need to make money. To make money, you need to attract new customers. You also need a clear and up-to- date understanding of how much money you’re making, where it’s coming in from, and where it is going. An accountant can not only help with financials, but they can advise you on other business decisions.

- Seek opportunities to network. Attend events and educational seminars to increase your knowledge, discuss new concepts, and exchange ideas with your peers. Meet people who share your perspective or who may show you a new one. Don’t be afraid to break the rules.

- Entrepreneurs often have to forge their own path, take the road less traveled, and do it their way. Sometimes it’s necessary to break the rules to grow and succeed.

This is a really thorough report and well worth reading.

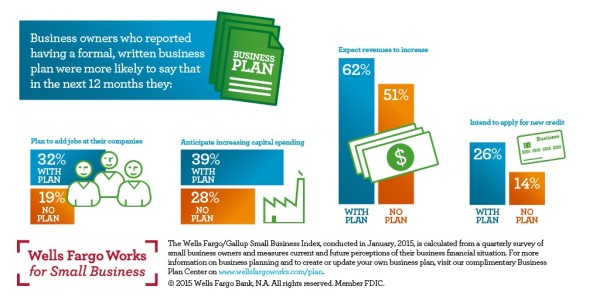

2) Speaking of Business Plans

Despite the fact that almost everyone advises small business owners to make sure they write a business plan, a recent Wells Fargo survey indicates that only 33 percent of business owners have a formal business plan. The survey also shows those entrepreneurs with a business plan also have significantly higher expectations for the year ahead.

The business owners with plans were more likely to report that in the next 12 months they expect to:

- Add jobs (32 percent versus 19 percent without plans).

- Grow revenues (62 percent versus 51 percent)

- Increase capital spending (39 percent versus 28 percent)

- Apply for new credit (26 percent versus 14 percent).

To help Wells Fargo is launching The Business Plan Center, a new Wells Fargo Works for Small Businessoffering that provides online tools to help business owners create and update their own business plans. There’s a Business Plan Tool, a step-by-step guide to develop a written business plan and a Competitive Intelligence Tool, which provides business owners with key insight on competitors and the market for their businesses that can be used as part of the planning process. Other interactive learning resources on the new Center include videos, articles and infographics covering essential elements of a business plan.

3) Work On the Go

America is going mobile—both consumers and business owners. A survey from live chat software platform company, LivePerson shows 69 percent of SMBs are doing work on the go via mobile and 25 percent do more than half their work via mobile phone or tablets. That percentage is up sharply from two years ago when only 13 percent of the survey respondents did that much of their work via mobile.

One interesting finding was that while the business owners say customers prefer to contact them for support via phone, 63 percent would prefer to connect with customers via digital and messaging. LivePerson says this shows many small businesses may not have the proper digital messaging channels in place in order to efficiently connect with their customers.

The survey also reveals that the main priority for small businesses in 2015 is to enhance the customer’s experience and support. Taking a deeper dive we see:

- SMBs rank customer experience and support as highest priority for 2015, but can spend less than 10 percent of their time on customer service.

- 25 percent of small businesses are managing more than four different communication platforms

- SMBs expect to see the most investment and growth in social media in the next two years.

- SMBs would like to see their customers contact them more often via live chat.

- Almost 30% of survey respondents agreed that customers were visiting their mobile site or app more frequently than before

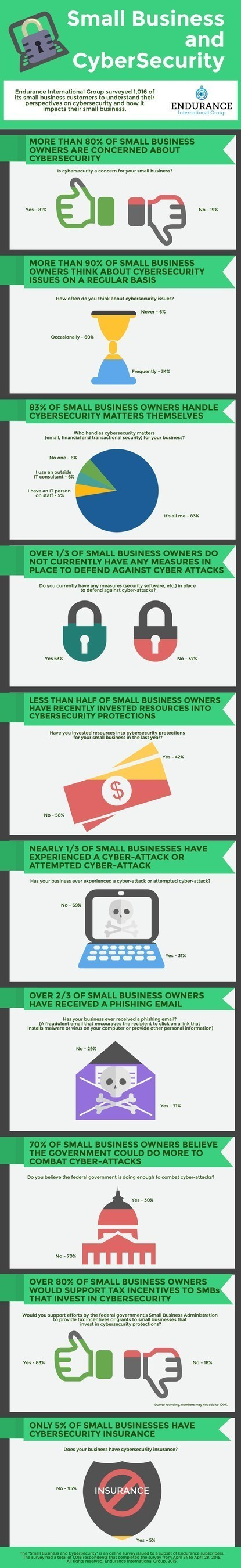

4) Fighting Cyber Attacks

Endurance International Group just released the results of its 2015 Small Business & CyberSecurity survey, which shows 81 percent of small business owners are concerted about cybersecurity, with 94 percent saying they frequently or occasionally think it. The survey also found that 31 percent of small businesses have experienced a cyberattack or attempted cyberattack, yet despite these concerns, only 42 percent have invested resources in cybersecurity protection in the last year.

Additionally, the survey says 70 percent of small business owners don’t believe the federal government is doing enough to combat cyberattacks and 83 percent say they’d support federal tax incentives or grants to small businesses that invest in cybersecurity measures.

“Cyberattacks aren’t just about targeting big business,” says Endurance CEO and founder Hari Ravichandran. “From phishing emails to social engineering schemes, small business owners need to be on high alert as hackers find new and creative ways to infiltrate their businesses. Our survey shows that small business owners may not be equipped to handle these new challenges. In our current environment, it’s not a question of if your business will be targeted, but when. This should be a wake-up call to both lawmakers and the small business community that we must remain vigilant in protecting against these cyber-threats.”

Of the small businesses surveyed, 95 percent do not have cybersecurity insurance. And most (83 percent) of the entrepreneurs handle their own cybersecurity matters, such as email, financial and transactional security, and do not have IT staff or utilize an outside resource.

5) Cool Tool for Financial Confidence

Sage North America, a provider of business management software and services to SMBs, just announced added functionality, new capabilities and a new pricing model for Sage One Accounting, simple online-based accounting and invoicing software. Sage One Accounting offers free and premium subscriptions with features for invoicing, cash flow management, and financial analysis. Sage One Accounting’s mission is to help small business owners take care of their daily tasks quickly so they can get back to running their business.

In the 2015 State of the Startup Survey (mentioned in #1 above) Sage found that 36 percent of surveyed small business “nurturers” (third parties such as venture capitalists, angel investors, accountants, and attorneys) indicated they have a “somewhat to extremely low trust of financial statements they receive from startups.” At the same time, when startups were asked about how they handle accounting for their business, 21 percent do accounting manually on paper, while 27 percent use their own home-grown systems.

“All small businesses need access to a simple and efficient way to manage their accounting and invoicing needs to ensure their finances are in order, while instilling confidence in their customers and partners,” says Mike Savory, Sage One product manager.

The new Sage One Accounting allows small businesses to perform accounting tasks and cash flow analysis to make better strategic financial decisions for their business, including:

- Tracking income and expenses.

- Receiving online payments with Sage Payment Solutions and PayPal®.

- Managing receivables and payables

- Printing financial reports

- Batching transactions

- Managing and planning cash flow

- Linking with bank and credit card accounts

- Reviewing data by analysis codes

- Accessing by mobile device

The free subscription of Sage One Accounting provides small businesses with the tools necessary to perform accounting tasks, including the ability to send five invoices per month, link a bank account, and create unlimited quotes, expenses and bills. The Sage One Accounting premium subscription is available at a $5 per month introductory rate (valued at $10), offering unlimited expenses, invoices, bills, and quotes and the ability to link to an unlimited number of bank accounts. This subscription also includes multiuser and multicurrency invoicing options.

Plus, small businesses working with the Sage One Accounting premium subscription can collaborate with their accountants using Sage One Accountant Edition, which allows accountants to connect with their clients’ data from anywhere.