17 Things Small Business Owners Need to Know

By Rieva Lesonsky

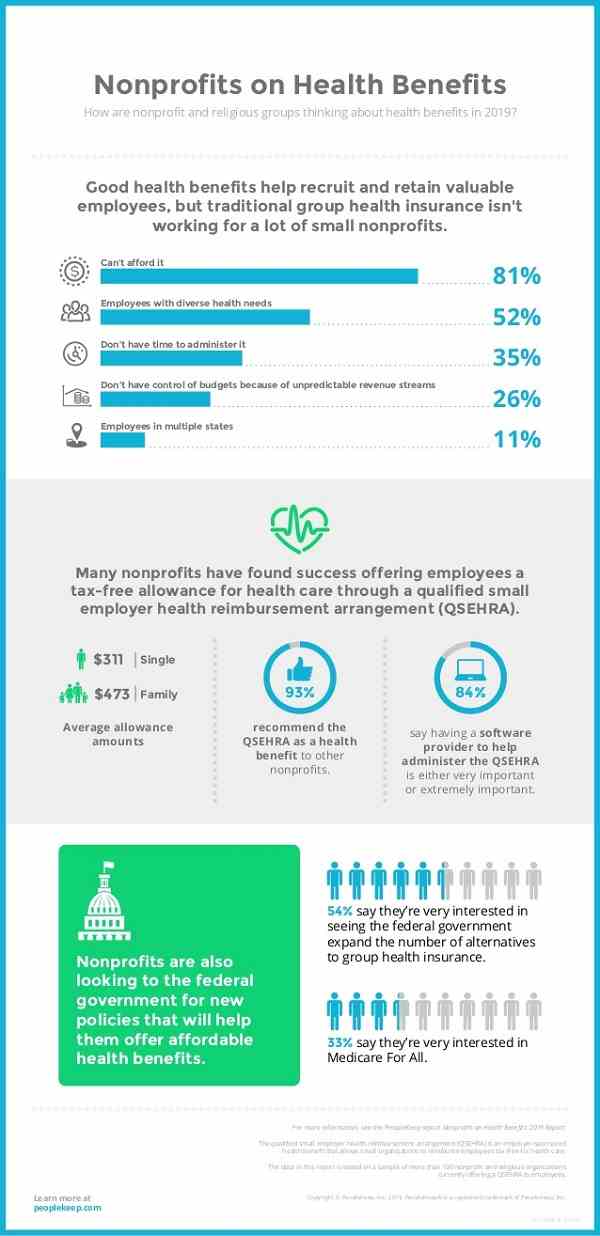

1—Benefits for Nonprofit Employees

PeopleKeep recently released its Nonprofits on benefits: 2019 report, which shows:

- Over 80% of small nonprofits cannot afford traditional healthcare. With 1.5 million non-profits nationwide, that is a substantial number of companies struggling to provide healthcare

- Only 33% consider Medicare-for-all to be a good solution

- 93% of QSEHRA (qualified small employer health reimbursement arrangement also known as a small business HRA) users would recommend it to other non-profits

Learn more in the infographic below.

2—Tools to Help Small Businesses Around the World Thrive

Mastercard and Zoho are expanding their partnership to bring small business owners around the world a comprehensive array of products and services to make running their companies easier, more efficient and more profitable. And while every business is on a quest to increase efficiency and productivity—for small business owners it can be a matter of survival.

With the Zoho platform, Mastercard is able to offer its small business customers access to a suite of marketing, accounting and CRM tools to automate and digitize time-intensive, paper-based processes. Zoho and Mastercard already had a partnership in India—and now they’re scaling it to the rest of the world—enabling simpler business operations for SMBs internationally.

“When Mastercard and Zoho come together, we’re able to pair our smart solutions and scale to fundamentally address some of the challenges small businesses owners face every day,” says Zahir Khoja, executive vice president, Global Acceptance at Mastercard. “These entrepreneurs drive job creation, productivity and growth globally; it’s critical that we find partners and develop solutions that allows us to help them succeed.”

“We are excited to partner with Mastercard, a company committed to empowering small business owners across the globe. This partnership connects small businesses to innovative applciations that enable them to access, manage and analyze real-time information that are critical to their success,” says Sridhar Vembu, CEO of Zoho Corporation. “Together, Zoho and Mastercard simplify the daily responsibilities of these entrepreneurs and help their businesses grow and thrive. As partners, we embark on our joint mission to fuel the global small business economy.”

Zoho is a cloud-based platform accessible via website and app and can be delivered via API. Zoho’s technology stack is flexible, taking the heavy lift off the integration process and making bringing solutions to market faster. Mastercard and Zoho shared solutions will be available later this year.

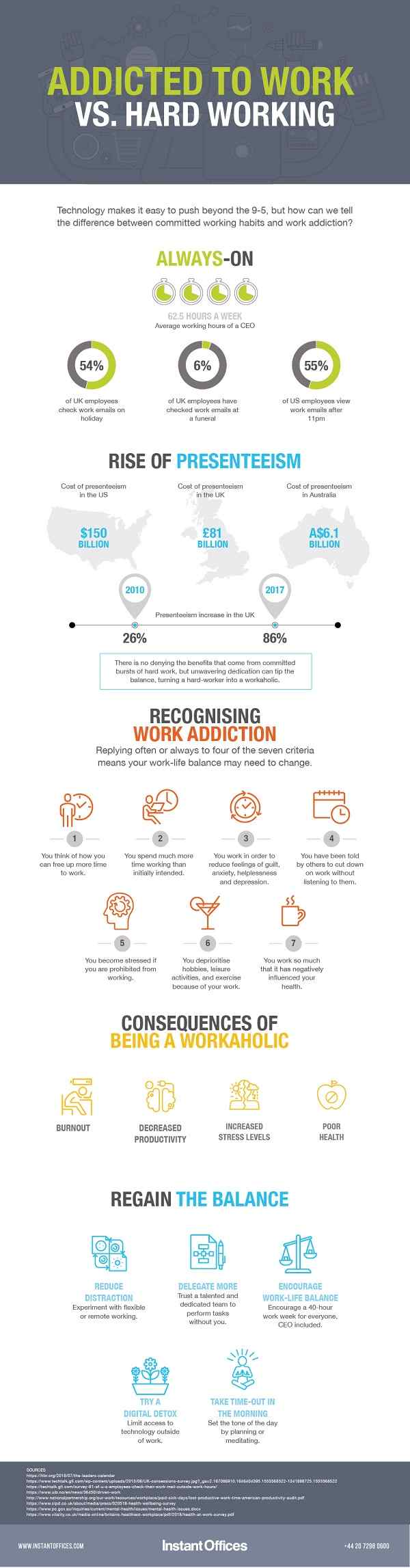

3—Recognizing Work Addiction in the Workplace

Guest post by Lucinda Pullinger, Global Head of HR at Instant Offices

The growth of technology combined with the idea that we need to work harder to achieve more is a popular concept in the modern workplace. And, according to a study by Techtalk, 55% of U.S. employees have admitted to checking work emails after 11pm. Research by Harvard Business Review also shows the average CEO works 62.5 hours a week—around 21.3 hours above the global baseline of 41.2 hours.

As technology makes it increasingly easy to push beyond the 9-5 here are some pointers on how workers can recognize the difference between committed working habits and work addiction.

With smartphones, computers and apps at our fingertips, we’re able to maintain a constant connection to our work. In theory, these tools should make our workdays shorter and more efficient, but constant distractions and the inability to disconnect can lead to longer work hours and less to show for it.

According to the Bergen Work Addiction Scale, replying ‘often’ or ‘always’ to at least four of the following seven criteria may indicate a work addiction:

- You think of how you can free up more time to work.

- You spend much more time working than initially intended.

- You work in order to reduce feelings of guilt, anxiety, helplessness and depression.

- You have been told by others to cut down on work without listening to them.

- You become stressed if you are prohibited from working.

- You deprioritise hobbies, leisure activities, and exercise because of your work.

- You work so much that it has negatively influenced your health.

Impact on Employees: Work-obsessed CEOs run the risk of creating a business culture in which presenteeism reigns. In fact, a study of 29,000 working adults by American Productivity Audit revealed presenteeism costs the U.S. more than $150 billion a year.

As opposed to being absent from work, presenteeism leads to employees having lower productivity while at work. They’re also likely to feel judged according to how many hours they sit at their desks rather than the quality of their output. This can lead to burnout, unhappiness and increased health issues, which end up impacting both company and employee negatively in the long run.

Impact on Business Growth

CEOs who work too hard may have trouble delegating effectively or even end up micromanaging teams, which can lead to a bottleneck in the company. It also sends the message to employees that they’re not trusted or talented enough to meet expectations, which can cause tension and unhappiness.

In a Harvard Business Review study of 27 CEOs over three months, time management proved the greatest challenge for most, while email usage was the top interrupter of the day. Leaders in the same study spent 72% of their time in work meetings, with the average meeting length being one hour.

One of the biggest time wasters for employees is distraction at work. Around 60% of employees say meetings are a big distraction that impact productivity according to Udemy, ultimately leading to longer hours spent working.

How to Regain the Balance

While the dedication to put in extra hours is a valuable trait, it’s important to manage a healthy balance in the long-term. One of the major differences between a hard worker and a workaholic is the problems that are caused as a result. Poor health, guilt when not working and increased stress levels are often consequences of work addiction. Here are a few ways to combat it:

Trust your team: For a team to grow successfully, it’s important to attract and retain talented employees, delegate effectively, and trust them to perform tasks without you. This will free up time for you to focus on strategy and growth.

Reduce distraction: Shorten meetings, set dedicated working times where people can focus and create a culture of face to face interaction rather than using email. Around 40% of employees believe work distraction could also be drastically reduced with flexible and remote working options.

Encourage work-life balance: Instill a 40-hour work week for everyone, CEOs included, with an emphasis on results rather than hours spent at a desk.

Try a digital detox: Set the tone in your organization by normalizing the fact that employees don’t have to adopt an always-on attitude. There are several apps that can assist by locking your devices for a period of time.

Allow mornings to set the precedent for the rest of the day: Whether taking time out to exercise, read, meditate or plan for the day, prioritize setting the tone for the hours to come every morning.

There’s more info in the infographic below.

4—Retail App Use Surges 50% As Consumers Shop Year-Round

Liftoff, a leader in mobile app marketing and retargeting, today released its third annual report on the ever-growing market of mobile app commerce in partnership with the industry leader in mobile measurement and fraud prevention, Adjust. The study, pulling from the most extensive dataset to-date, shows that shopping app users are becoming increasingly purchase-happy in what is poised to be the biggest year in mobile commerce ever. The report also uncovers key insights into regional mobile shopping behavior, suggesting the rise of “Mobile Window Shopping” in Asia-Pacific (APAC) and North America (NAR).

Analyzing more than 90.9 billion ad impressions across 13.6 million installs and 3.9 million registration and purchase events between April 2018 and April 2019, the report found:

The traditional ‘make-or-break holiday shopping season’ is dead as mobile users spend all year long: Historically, retail app marketers are laser-focused on the holiday shopping season—from Black Friday through the New Year—to target consumers ready to spend. This year’s trends, however, beg the question: is holiday shopping still a make-or-break period for e-commerce?

The cost to acquire a first-time retail app user hovers in the $30 to $45 range throughout the year, showing significant stability compared to last year’s more volatile and expensive landscape. Consumers are more comfortable on mobile overall, with year-over-year acquisition costs dropping by a third, while install-to-purchase rates have skyrocketed nearly 50%.

With a growing number of global retail giants establishing their own annual shopping holidays—think Flipkart’s Big Shopping Days in May, Amazon Prime Day (today), and Alibaba’s Singles Day in November—users no longer need the winter holidays as an excuse to buy; they’re primed-to-purchase all year long.

“Winter holiday shopping is still alive and well, from mobile to brick-and-mortar,” explains Liftoff cofounder and CEO Mark Ellis. “But our data shows consumers now spend steadily all year long, suggesting the traditional holiday shopping season won’t make or break a brand as it might have in the past.”

The data suggests linking mobile advertising campaigns to traditional holidays is somewhat passé. For mobile marketers looking to get the best return on their marketing dollar this year, throw away preconceived notions and target users year-round.

Retail app browsing may be the new window shopping: In both APAC and NAR, users are clearly open to exploring retail apps, with registration rates skyrocketing and acquisition costs dropping year-over-year. But the data points to a surprising new trend— “Mobile Window Shopping.”

While users install and register in retail apps with ease, the joint report shows a sizeable drop-off at the all-important purchase stage: APAC’s cost-per-first-purchase comes in at $31.26 (up 13.3% year-over-year), coupled with a low 10.1% conversion rate. The same is true of NAR, where cost-per-first-purchase nearly doubled year-over-year ($58.86), while purchase rates dropped off by nearly 60%.

The driving force of this drop-off is uncertain, but it could point to a larger retail trend: the revival of brick-and-mortar. Digital-first companies like Amazon and Warby Parker are leading a move toward ‘connected’ physical stores, while research shows Gen Z consumers prefer browsing for deals on mobile and completing the purchase in-store.

“For marketers looking to boost purchase rates, the key is to utilize the data they have, understand potential drop-off points and to segment and target properly,” says Christian Henschel, cofounder and CEO at Adjust. “Brands can then create and deliver the perfect user interaction strategies for their marketing initiatives. This personalization is key to winning over fickle consumers and building long-term loyalty.”

Savvy marketers can integrate shopping apps into a larger marketing strategy, offering exclusive deals via app to entice consumers to head into stores or offer limited-time specials to encourage in-app purchases.

For more key retail app marketing insights, take a look at the full report.

5—Identity Management

LastPass by LogMeIn recently announced the results of a new study conducted by Vanson Bourne to offer SMBs insights into the state of identity and access management (IAM) and actionable steps to improve their IAM program. The study, SMBs Guide to Modern Identity, surveyed 700 global IT and security professionals at organizations ranging from 250 to 2,999 employees and found 92% are experiencing at least one challenge when it comes to identity management, with 47% citing ease of use with security as the biggest challenge.

This research comes on the heels of the general availability of LastPass’ new comprehensive identity suite—a collection of MFA, SSO and Password Management solutions aimed at addressing the identity and access in a small or medium business.

Data from the report reveals 82% of IT professionals agree poor identity practices have exposed their businesses to risks, citing incorrect access controls (41%), loss of employee data (36 %) and loss of customer data (33%) as the biggest consequences. Despite this, many have not implemented an adequate identity management solution.

“When used individually, enterprise password management, SSO, and multifactor authentication, all bring unique security and productivity benefits to a business,” says John Bennett, General Manager, Identity and Access Management Business Unit at LogMeIn. “But when brought together under one solution, businesses have complete security and visibility into every user and access point in their business. Something 93% of the surveyed IT professionals agreed with. With more limited resources, it’s particularly important for SMBs to look for all-in-one solutions that combine the key components and maximize an investment identity technology.”

Additional key findings

Passwords Continue to Cause Frustration and Risk: On average, IT security teams spend 4 hours per week on password management-related issues alone and receive 96 password-related requests per month. Given the ongoing resource drain that passwords pose to organizations, 95% of IT security professionals report their organizations should place more emphasis on the importance of strong password behavior.

Single Sign-On Serves a Crucial Role—But Leaves Critical Gaps in Isolation: Given the risks and resource drain associated with passwords, SSO solutions offer the benefit of eliminating passwords for IT-supported apps and simplifying the login process for employees accessing key apps in the cloud and behind the firewall. However, many apps aren’t integrated into an SSO solution. Although the research shows 80% of IT professionals agree relying on SSO alone is not enough since it still leaves a variety of cloud apps and privileged accounts unsecured.

Upgrading Identity Capabilities is a Top Priority For SMBs: 98% of IT professionals see room for improvement in the general security behavior of their employees (creating strong passwords, secure sharing and collaboration). Due to competing priorities, IT teams are struggling to address these security needs. When asked about next year’s IT security objectives, 65% agree upgrading their Identity and Access management capabilities is a priority. When asked for ideal features in an identity solution, respondents noted multifactor authentication (55%), integration with current infrastructure (52%), built-in password generator (44 percent), support for both legacy and cloud apps (44%) and an integrated system for managing, monitoring and setting policies (44%).

Balancing Ease of Use and Security Is a Challenge When Implementing an Identity Solution: Given that security is a high priority for most SMBs, it’s no surprise many are investing in identity solutions. Less than 1% of IT professionals believe managing user access is unimportant to the overall security of the organization. Unfortunately, 92% of organizations also say they are experiencing at least one challenge when it comes to identity management. The average organization struggles with three identity-related challenges: 47% of respondents say balancing ease of use with increased security was a hurdle, 40% cite the general security of their solutions and 37% are facing demands from employees for a solution that’s easy to use.

There’s more information here.

6—Helping Hourly and Gig Workers Get Early Access to Wages

According to McKinsey 27% of workers are engaged in an independent or “alternative” work arrangement as their primary job. And this trend is expected to continue. Yet, we’re still often relying on traditional payment models to compensate these workers—many of whom are living paycheck to paycheck. Mastercard has a long-worked with companies like Uber, Lyft and Care.com to help gig workers get paid faster.

Mastercard is expanding its commitment by partnering with Evolve Bank & Trust (Evolve) to enable companies to pay gig and independent workers in advance of their regular payment schedule. Mastercard Send is a push payment solution, that can send funds in near real time to any debit card using Branch, which works with large organizations to provide interest-free, pay advances to their hourly workers and gig workers.

Branch provides early wage access so employees can manage any lag between when bills are due and when their paychecks are received. With Mastercard Send, Branch can push funds in near real time to U.S. debit cards.

“Gig workers provide just-in-time services that help both consumers and businesses fulfill real-time needs,” says Jess Turner, executive vice president, Product and Innovation, North America, Mastercard. “But when it comes to getting paid, they are stuck in a traditional model of work now, get paid later. With Mastercard Send, we want to provide a new wage system—one that is in tune with the workforce of today.”

“At Evolve, we understand that the workforce in the U.S. is changing,” says Scott Stafford, President and CEO, Evolve. “With Mastercard Send, we were able to create a payment infrastructure that serves a new generation of workers and helps them manage income volatility.”

The research shows one-third of U.S. gig workers received approximately $236 billion through pay advances in 2018, in contrast to loans that come with unclear terms and fees. These advances help alleviate the stress of living paycheck to paycheck and provide an opportunity to plan ahead and stabilize finances.

“As hourly workers’ schedules tend to fluctuate, so do their earnings and their ability to meet day-to-day financial needs,” says Atif Siddiqi, CEO, Branch. “Branch helps increase financial stability among hourly workers by providing them instant access to earned wages, budgeting tools, and the opportunity to pick up more shifts.”

Mastercard’s commitment to helping people improve their financial lives in meaningful ways over the long term is a key pillar of its inclusive growth program in North America, which offers specialized products and services for gig workers and next-generation workers.

7—Americans Prefer Shopping at Stores that Conduct Employee Background Checks

Sterling, a leader in background and identity services, just released the results of its 2019 Retail Industry Screening Survey. The inaugural initiative examines Americans’ perspectives, experiences and concerns related to retail screening—covering topics from customer service to holiday shopping to cannabis screening.

According to the survey, 67% of Americans say they are more likely to shop at retail stores whose workers have been background checked than at retail stores where workers have not been background checked.

In addition, 49% say if they found out a store they go to doesn’t background check all their workers, they would be less likely to go back to that store.

“A comprehensive screening program will help find top talent and reduce employee turnover, as employers are looking for long-term workers and focused on developing new hires into managers and leaders,” says Vincenza Caruso-Valente, General Manager, Sterling.

The study also found:

- Marijuana testing:65% of Americans say drug testing retail workers for cannabis is unnecessary.

- Holiday shopping:53% say during the holiday season, they notice retail workers tend to be lower quality than they are during other times of year.

- Service:81% say while shopping, when deciding what retailer to go to in person, they factor in a retailer’s quality of customer service.

“For retailers, maintaining a robust and consistent hiring process is paramount, and helps attract strong talent that can be retained and redeployed. Retailers also benefit from viewing their customers as potential employees, and from recruiting their talent through technology-enabled solutions. Caruso-Valente adds, “A healthy hiring program will cultivate a strong culture—and brand—of customer service.”

The report can be found here.

8—A More Powerful Campaign Manager

Guest post by Amita Paul, Senior Product Manager, LinkedIn Marketing Solutions

You’ve shared with us that one of your biggest marketing challenges is ensuring your campaigns can meet increasingly complex business goals. Whether you’re a new startup trying to increase share-of-voice or an established B2B player looking for leads, you need solutions that are flexible and can adapt to your unique objectives.

LinkedIn is excited to announce three new objectives—brand awareness, website conversions and job applicants—are the latest additions to our redesigned Campaign Manager, which we first introduced in October as a public beta. These new offerings are designed to continue to make it easier to improve key results and better align with your campaign objectives. Early results show it’s working—we’ve seen a 67% lift in customer satisfaction compared to our legacy Campaign Manager experience.

A full funnel experience to help you achieve more of your goals: Our latest version of Campaign Manager is the next step in our effort to give you the tools you need to create campaigns and measure their impact. These new objectives include:

- Brand awareness: You can now increase share-of-voice for your product or services through top of funnel campaigns that charge by impressions (e.g. cost per thousand or CPM).

- Website conversions: We’ve built a tighter integration with our conversion tracking tool so you can create campaigns that are optimized for specific actions on your website, like purchases, downloads or event registrations.

- Job applicants: LinkedIn Talent Solutions customers who are trying to drive applications on LinkedIn or their own site, can now create ads using Campaign Manager.

Click pricing optimized to your campaign objectives: With the improved Campaign Manager, we’re also optimizing our click pricing to align with your objective. If you select website visits as your objective, you will only be charged for clicks that go to your landing page. For social engagement campaigns, pricing will be optimized for all social actions (likes, comments, shares, etc.).

There’s more about objective-based advertising in the help center.

9—Working Seniors

As the retirement age slowly creeps up, it’s not surprising to learn many seniors are working longer. This could be due to several factors, such as financial reasons or simply wanting to continue working out of enjoyment. Regardless of the reason, it’s clear a large number of seniors are still working in cities throughout the country.

Provision Living has compiled a thorough and fascinating list of the top 25 cities where at least 20% or more of the senior population is still in the workforce.

See the list of all 25 cities and learn more in this blog post.

10—How to Have a Productive Argument at Work

Professionalism is nothing without passion. The instincts and experience that make your opinions unique are highly valuable. Balancing them with your colleagues’ ideas empowers the team to find the best solutions for the challenges and opportunities that arise each day.

And when disagreements arise, a productive argument can result in a better outcome for everyone.

Healthy debate has proven an excellent way to develop ideas since at least the time of Plato and Socrates. But it has to be done right, because when those passions lead to raised voices and blaming, progress grinds to a halt. Most of us don’t know how to make a virtue of differing opinions—so it’s no wonder that 71% of senior managers believe meetings are mostly unproductive.

In fact, productive arguing is a professional skill like any other. Being able to argue your point well is important. Use a reasonable voice and body language to ensure your message is heard and considered by the rest of the team. Also try using statistics and visuals to give your ideas weight.

There’s more information in the infographic below from Resume.io.

11—What You Need to Know About Project Management Software

Capterra, the leading online resource for business software buyers, recently released findings from its latest survey of project management (PM) software users and uncovered new trends related to how these tools are being used to impact purchase, implementation and growth decisions.

When making software purchasing decisions, functionality remains the most important factor, according to the study, Project Management User Research Report. Project management software buyers are also now placing much greater emphasis on price, which ranks as the second highest consideration when making purchasing decisions, followed by customer support and ease of use.

“Organizations across industries need project management tools—and many of them needed them yesterday,” says Eileen O’Loughlin, senior project management analyst at Capterra and the survey’s lead analyst. “Nearly 70% of users evaluated and purchased PM software in less than six months. This quick adoption shows just how critical PM tools are as businesses look to streamline and improve workflows.”

Key findings of the Capterra Project Management Software User Research Report include:

- Cloud-based PM tools are rising: 60% of users deploy cloud-based solutions on their current PM tools compared to 40% who use on-premise/desktop solutions. This reflects the consumer shift towards cloud-based tools that provide access to information and updates in real-time, across all devices.

- Cost is more important than simplicity: Users’ cost-consciousness plays a key role in purchasing decisions: 49% of users start their search expecting to pay less than $5,000 annually and 49% end up spending that amount.

- Reality meets expectations: Users are largely satisfied with their current PM tools (70% of users), reporting positive gains in several areas, specifically improvement in the number of projects completed on time.

- PM software usage is evolving: The most desired project management features are task boards, portfolio management, and gantt charts. Project management software has evolved from tools designed solely for technical users to include tools designed for non-technical business professionals known as “accidental project managers.”

Project management software adoption is on the rise as business leaders understand the importance of increasing operational efficiencies across their organizations—and see the value of project management software in meeting crucial business goals.

12—New Industry-First Injury-Free™ Benefit and Rainy Day Fund

Accident insurance helps families offset the expense of injuries requiring treatment they might ordinarily have to cover out-of-pocket to meet their plans’ deductible. Simply, it pays employees directly for common injuries and associated medical treatments and services. Driven by consumer insights, Guardian’s accident insurance now features:

- Injury-Free Benefit™pays the employee a cash benefit if their family is claim-free for five years. Guardian will pay the benefit even if there are wellness and/or concussion baseline study claims filed during this period.

- Rainy Day Fundpays up to $500 annually to cover costs that are insurable by an individual policy but are not covered by the policy due to limitations, like frequency of follow-up visits or physical therapy sessions, over a defined period of time. For any amount unused over the course of the year, up to half of the original fund will be carried over to the next year, up to a limit of $1,000

- “We asked consumers what they wanted most in an accident product to better understand what they would value and appreciate. Our latest enhancements provide maximum coverage to give them what they want—a return on their investment,” says Mike Estep, Vice President, Group Products & Worksite Leader, Guardian. “Offering Guardian Accident Insurance can help employers strengthen the financial security of their workforce and help employees manage high healthcare deductibles.”

Accidents happen: Employers can offer this employee-paid insurance coverage to enhance their overall employee benefits package and help boost employees’ financial protection.

Additional key features of Guardian’s Accident insurance

New Auto-Increase Benefit: Provides an automatic 5% increase in benefit each year for every policy for a maximum of five years with no increase to an employee’s premium.

Greater Plan Design Flexibility: Guardian now offers four standard accident insurance plans with a wide range of coverage options.

More Covered Features: Includes post-traumatic stress disorder due to a covered injury, traumatic brain injury, gunshot wound, and outpatient therapies such as vocational, speech, respiratory or cognitive behavioural therapy.

Unexpected injuries can impact a family’s financial wellbeing and lead to increased stress. According to Guardian’s 6th Annual Workplace Benefits Study, 44% of working Americans in HDHPs say they have avoided receiving medical care in the past year because of their high deductibles. For the first time, employers can offer their employees accident insurance that can pay them back while backing them up.

To learn more about Guardian’s Accident coverage, click here.

Quick Clicks

13—Customer experience (CX) is key to winning consumer loyalty. Helpjuice explains why it’s so important small businesses learn to satisfy their customers in this guide.

14—Looking for an online stock trading broker? Benzinga ranks them here.

15—Ever wonder what Google knows about you? BroadbandSearch gives us the scoop—and it is kind of scary.

Cool Tools

16—What is Reverse Image Search?

Reverse Image Search is a type of online query where instead of using word or keywords you use an image. This service is helpful when you don’t know the item in the picture or its name, you just upload it and let the image search engine look it up for you.

This app from Reverse Image Search is very useful and simple to use.

17—Dell Deals in the UK

If you’re in the UK, check out these Black Friday in July deals from Dell. From July 15-19, there will be even bigger deals. Customers will have access to mega-deals from across the small business product range, including the laptops, desktops, monitors and accessories.

Products in the offer include (but are not limited to):

- XPS 13 with a huge £350 off

- Latitude 7490with £250 off

- OptiPlex 7060 Small Form Factor Desktopwith £160 off

- Dell 27 Monitor: S2716DGwith 50% off

Business stock photo by Yuttana Jaowattana/Shutterstock