12 Things Small Business Owners Need to Know

By Rieva Lesonksky

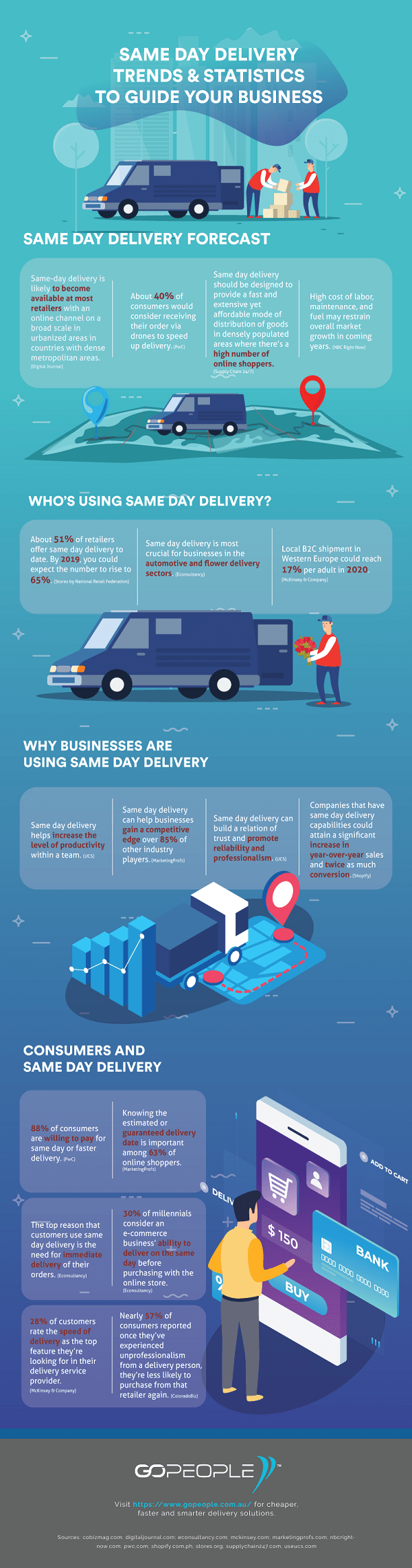

1—Same-Day Delivery

Globally speaking, same day delivery is no longer just a concept. Instead, it’s the standard practice in many industries nowadays. Fashion retailers, food and beverage companies, medical suppliers, car accessory manufacturers, and a lot more are now offering same day delivery service to consumers.

According to Australian-based GoPeople, for many customers, same day delivery is a great solution to their lack of time to go to brick-and-mortar shops to pick up the goods that they need. In fact, as much as 61% of shoppers are willing to pay extra for the convenience that same day delivery brings, which only shows that customers don’t like to be kept waiting.

There’s lots of facts and stats in the infographic below.

2—Association Health Plans: What Small Businesses Need to Know

Guest post by Sally Poblete, CEO of Wellthie. Poblete has been a leader and innovator in the health insurance industry for over 20 years. As a broker and former industry executive herself, she founded Wellthie out of a deep passion for making health insurance more simple and approachable for consumers and small businesses.

The U.S. Department of Labor recently announced regulations that will allow for the expansion of Association Health Plans (AHPs). But what exactly are AHPs, and what do they mean for small businesses?

Essentially, AHPs allow small businesses to band together to purchase health insurance. The definition of a small business varies by state, with most states capping it at 50 employees, and California, Colorado, New York, and Vermont at 100 employees. While we have seen efforts to promote AHPs since the 1980s, the new rules are unique in that they also allow sole proprietors to join the associations. Previously, sole proprietors could only buy individual coverage, but now they have the option of participating in the association plans.

The new rules allow carriers to introduce AHPs as early as September, so we may see plans on the market as soon as this fall and early next year.

How many small businesses and sole proprietors does this affect?

The expansion of AHPs has the potential to impact the lives of a huge number of people. Today, there are more than 35,000 associations in the United States, organized by geography (state or greater metropolitan area) or industry. Some examples include your local Chamber of Commerce, the National Restaurant Association, and the National Writers Union. Existing associations can be grandfathered in under the new AHP regulations, but new associations will have to meet the following criteria: 1) be in the same geographic area or the same industry and 2) have another business purpose other than offering health insurance.

Existing options for these small businesses and sole proprietors aren’t going away. Small businesses can still participate in the small group market and Small Business Health Options Program (SHOP), while sole proprietors will still be able to purchase individual coverage. AHPs will just add another layer of choice to the market.

Lower premiums: AHPs provide small businesses with the opportunity to offer health insurance at lower premiums, which is important because cost is one of their main concerns. Healthcare costs are an issue for almost everyone, but are especially significant for small businesses, which are usually juggling between growing their business and paying for increasing costs of growing their team. AHPs are likely to provide lower premium options for two reasons: 1) they are exempt from requirements to cover the 10 essential benefits required by the Affordable Care Act, and 2) the law allows for more flexibility in the way AHP premiums are set.

Thus, AHPs allow some small businesses to be able to offer health plans with lower premiums. In turn, these lower premiums may mean that businesses can offer insurance to their employees when previously they could not afford to do so.

Some caveats: While AHPs offer lower costs for some, it’s also important to remember that you don’t get the same benefits as you would with a traditional health plan. The Affordable Care Act outlined certain essential benefits that have to be included in health insurance plans, including preventive care, ambulatory services, emergency services, hospitalization, mental health services, maternity care, prescription drugs, rehabilitation, laboratory services, and pediatric care. AHPs are exempt from these regulations and may not cover some of these things.

The new AHPs are better for relatively healthy individuals without high needs for medical services. If you need any of the services mentioned above, or just generally utilize care more frequently, be aware that AHPs may not cover all the benefits you frequently use. The expansion of AHPs makes it especially important to understand plan benefits before purchasing health insurance. Buyers should compare premiums, benefits, and network coverage between AHPs and other existing options on the market (including fully-insured or self-funded plans). By doing this research, you can make an informed decision and pick a plan that best meets your employees’ health needs.

Providing health insurance as a small business can be costly, and Association Health Plans are an attempt to lower premiums and increase choice. While AHPs will result in more lower cost options, it is important to remember the plan benefits may not be the same as those in other more expensive health plans. Now more than ever, it is critical for consumers to do their research and make informed choices about health insurance. When in doubt, seek out the help of licensed experts who can guide you through your options and help you make the best decision for your business and your employees.

3—Money Mistakes

Who among us hasn’t made any money mistakes? According to a new study conducted by finder.com 78.3% of Americans admit they’ve made a money mistake. Both (20.1%) and women (20.2%) equally view dropping out of college as one of their biggest money mistakes.

But, topping the money mistakes charts was blowing too much on fun (63.6%), followed by dropping out of college (20.2%) and making a bad investment, such as property or stocks, (15.5%). Other mistakes included letting a partner control the finances (15.3%), too much gambling (8.9%), having children (7.9%), being caught in an online scam (7.7%) and paying too much for a wedding (7.2%).

Mistakes by generation

Gen X are the most likely to admit to a money mistake (79.1%), followed by Millennials (78.9%) and Baby Boomers (74.1%)

- When reflecting on their money mistakes, over 1 in 4 Baby Boomers admit to making a bad investment (26.6%), followed by Gen X (17.3%) and Millennials (11.4%)

- Not surprisingly, Millennials are blowing too much on fun (70.8%), followed by Gen X (59.7%) and Baby Boomers (46.0%)

Mistakes by household income

- Those earning between $50,000 to $75,000 admit to making the most money mistakes (83.4%)

- The more you earn, the more likely you are to say a bad investment (such as property or stocks) as a money mistake. Those earning $300,000+ lead the way at 31.6%, followed by those earning between $150,000 to $300,000 (31.1%), $100,000 to $150,000 (24.2%), $75,000 to $100,000 (20.5%), $50,000 to $75,000 (17.6%), $25,000 to $50,000 (13.4%), $0 to $25,000 (7.6%)

You can look at the whole report here.

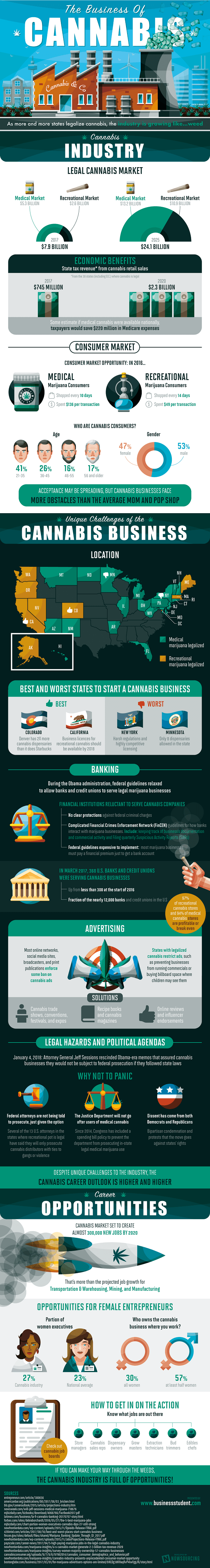

4—The Cannabis Business

The cannabis industry is projected to grow to $24 billion by 2025. To date, more than half of states have legalized medical or recreational marijuana use and that number is expected to increase. The team at BusinessStudent.com put together a report on The Business of Cannabis.

Here are a few facts:

- 97%of recreational stores and 94% of medical stores make a profit or break even.

- The average medical marijuana consumer purchases cannabis every 10 days and spends $136 per transaction.

- 27% of executives in the industry are women, 4%above the national average.

There’s more information in the infographic below.

5—Hiring Freelancers

The freelance market has an incredible impact on small business hiring trends as a new report from LinkedIn shows. Small businesses are at a disadvantage when it comes to hiring during times of low unemployment. It’s so much easier for large companies, with their ample resources and financial backing, to lure top talent leaving SMBs struggling jobs waiting to be filled.

The survey shows 70% of SMBs have hired a freelancer in the past with more than half of that activity happening in the last three months, and 81% plan to hire freelancers in the future. Reviewing previous research, more than half (52%) of small business hiring managers say that the number of freelancers and contractors in their company will increase in the next 5 years while 38% say the number will stay the same.

When small businesses hire freelancers, it’s often to not only to grow their businesses but to fill an expertise gap that is lacking at their company. Industries that have seen the highest employment in the freelance market are:

- Art & Design

- Accounting & Finance

- Consulting

- Consumer Goods

- Education

The most in-demand skill freelancers were hired for was “website design” irrespective of the size of the company/SMB. Another industry with lots of hiring activity was marketing and communications (with jobs in “marketing,” “advertising,” and “public relations”) with small businesses of 50 employees or more. In general, platforms like LinkedIn ProFinder prove an important point: small business hiring is trending upward across all sectors.

6—Digital Marketing Training from Facebook

At the recent annual conference of the National Urban League, the group’s president, Marc Morial, and Facebook COO Sheryl Sandberg announced a new partnership to provide digital skills training to entrepreneurs and small business owners in 13 cities nationwide beginning in 2019.

As part of the partnership. Facebook will offer in-person training in conjunction with local Urban League chapters so small business owners can learn the digital marketing skills they need to grow their businesses. Attendees will have the opportunity to be trained on Facebook tools including Business Pages, Messenger, Instagram and more, to help them connect with customers and best manage a digital presence. Following the training, all participants will be granted access to free online support to build upon these learnings.

The National Urban League will also join Facebook as a national advisor to help it work towards its goal to train 1 million people and small businesses in digital skills by 2020.

7—Win a Workplace Transformation

Intel and PCM are joining forces to help three lucky businesses transform their workplaces. Three grand prize winners will receive a $30,000 workplace makeover. One winning applicant will be selected in the categories of productivity, TCO, and security. Application deadline is November 1, 2018. Apply here.

Quick Takes

8—Retreat for Women

If you’re a woman who is juggling a lot and in need of some self-care, take a look at the Rest, Reset & Restore Retreat, taking place October 27 from 8 am–5 pm at Onion Creek Kitchens at Juniper Hills Farm in Dripping Springs, Texas. This location brings attendees closer to nature, where you can enjoy the peace and the company of the farm’s animals. S

The one-day agenda is ideal for busy women. The itinerary includes acoustic music, vegetarian cuisine, guided journaling, a nature walk, breakout sessions to cook or do yoga nidra, and of course, free time.

The retreat is hosted by me, Sandra K. Foreman, founder of The Spa in Me, LLC, a coaching company for women.

Tickets can be purchased online during the registration process for the Rest, Reset, and Restore Retreat at https://thespainme.com/, by choosing Retreats.

The Spa in Me is offering its 1st annual scholarship for the Retreat. The scholarship covers lodging for one woman only, from check-in at 3pm on October 26 until checkout at noon on October 28. It also covers the Rest, Reset and Restore Retreat on October 27, from 8am-5pm. The application process is open through August 31. A scholarship committee of five women will make the scholarship decision. More information is available here.

9—Reduce Your Stress

Do you feel your life is a little out of whack right now? So many of us do. If you do, check out this guide to surviving stress from Groom+Style. It’s full of great—and useful tips to help you achieve work/life balance.

Cool Tools

10—Approachable Accounting

FreshBooks recently launched what it calls “approachable accounting,” accounting software built, not for accountants, but for small business owners. You can learn more here.

11—Sending Electronic Checks

More than 2 million small businesses use QuickBooks Online—1,500 new small businesses begin using QBO every day. If you’re one of them—and you prefer to pay by check, check out this free add-on from Deluxe. A recent study found small businesses write eight times as many checks as their retail customers.

The add-on seamlessly links Deluxe eChecks with QuickBooks Online, uniting the reliability of checks with the ubiquity of QBO. It differs from Intuit’s existing electronic checks functionality, which are actually ACH transfers.

The new Deluxe eChecks add-on lets users access their accounting details and easily send eChecks without the time and financial costs of stuffing envelopes and mailing them. And you don’t have to obtain payees’ banking info—all you need is their email address.

Setup is simple—it takes less than five minutes and require additional software. You can learn more and get started here. For more answers, visit the “Integrating Deluxe eChecks with QuickBooks” section of their FAQ page.

12—New Templates for Your Small Business

Xtensio, a SaaS-based creative collaboration platform, recently released two new templates—the Sales Sheet Template and the Resume Template.

The Sales Sheet Template allows teams to create a living sales sheet that clearly and concisely outlines their products or services. In this template, teams can include a tagline that clearly and succinctly summarizes the product’s importance, followed by a description of what the product is and how it brings value to its ideal customer. Teams may also include various benefits, backing their solution with solid data, as well as high-quality visuals to give a better idea of the product. The template is complete with the addition of product comparisons, testimonials and a strong closing statement and call to action.

The Resume Template helps users showcase their professional background clearly and accurately. Users can provide their full name, contact information, various skills, as well as an in-depth “About Me” section. They may also include current and previous work experience, insightful personality notes, education history, volunteer experience, and certificates and honors, if applicable.

There’s more information available here.

Business stock photo by S_L/Shutterstock