Sponsored by Token

By Rieva Lesonsky

It seems like not a week goes by that we don’t hear about another merchant having their accounts hacked—and your credit card number being at risk. We all are aware that when we’re in an airport, hotel room or other location with an open, unsecured Wi-Fi connection, it is risky to make a purchase, and we have to wait—sometimes days—until we get to a secure Wi-Fi location. But did you know payment hacks can happen at any time, in any place—even in the comforts of your own home or office, where you think you’re safe?

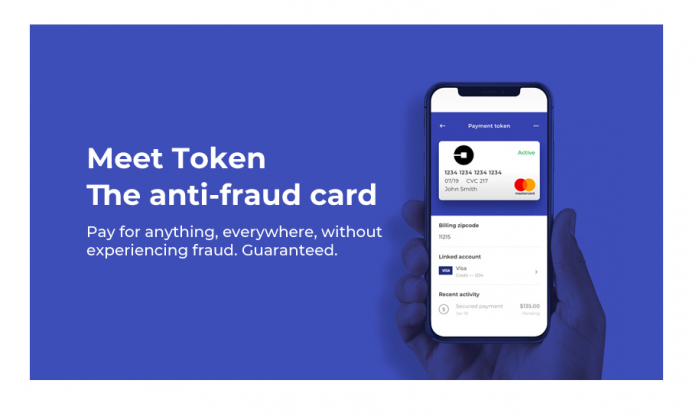

It all makes for stressful shopping and purchasing experiences. Well, thanks to a new app, Token, you don’t have to worry about this anymore. The process is simple. You go to the App Store or Google Play and download the Token app.

In the vast majority of the cases (92% I’m told) you’ll be accepted on the spot. My experience wasn’t that smooth—they couldn’t immediately authenticate me. Instead of a negative, this just underscored how seriously Token takes its own security. And it turned out, the mistake was mine—I made a typo when entering my name on my iPhone.

The Token app randomly generates what the company calls “next generation virtual cards”, (known as a Token). You link the Token to any credit card you want—or your bank account. You copy the number of your Token (with one click), go to a merchant, select a new way to pay, paste the number of your Token in the appropriate place, use the address of the account you linked to—and you’re done! Purchase made—without exposing your credit card number.

If you want to make multiple purchases, simply create a new Token for each merchant. And even if that company is hacked—there’s no real credit card or bank account number for them to steal.

It’s that simple. I’ve been on the road for a week and I needed to get a book delivered to my home timed to my arrival. I was able to order a book from Amazon and a calendar from Barnes and Noble from my hotel room, with no fear of being on an unsecure Wi-Fi network.

Token is completely secure—it enables you to protect yourself from payment fraud. Token says the “Tokens are tied to the first merchant where they are used. If a hacker tries to use a Token anywhere else, the transaction will be denied and you’ll be notified. However, you’ll still be able to shop at the original merchant using that Token.

You’re in control of your Tokens. You can freeze, unfreeze or cancel them any time you want. Tokens are run through the Mastercard network, but you can tie your Token to any credit card you want, which can actually extend the reach of a card like American Express, which is accepted in fewer places than Mastercard.

All transactions are monitored by Token, to make sure they’re not fraudulent. And soon, you’ll be able to track all your transactions, in real-time on your phone, through Token’s web app, and on your bank or credit card statements.

Using Tokens is simple—and free. And the peace of mind you get when using the app, is just a bonus.

SmallBizDaily readers can save $5. Just download the Token app and use the code SUMMER18.