5 Things Entrepreneurs Need to Know—Small Business Week Edition

By Rieva Lesonsky

In honor of Small Business Week, we’re bringing you three bonus editions of Things Entrepreneurs Need to Know. Be sure to check the regularly scheduled column, which posts here almost every Saturday.

National Small Business Week Special Report

1) Best Cities for Startup, Part 1

If you’re thinking about starting a small business, are some locations better than others to launch. Yes. But those best cities differ, depending on the criteria.

Two recent surveys have named the top cities for startup. Check them both out to see if one of the top cities can entice you to move.

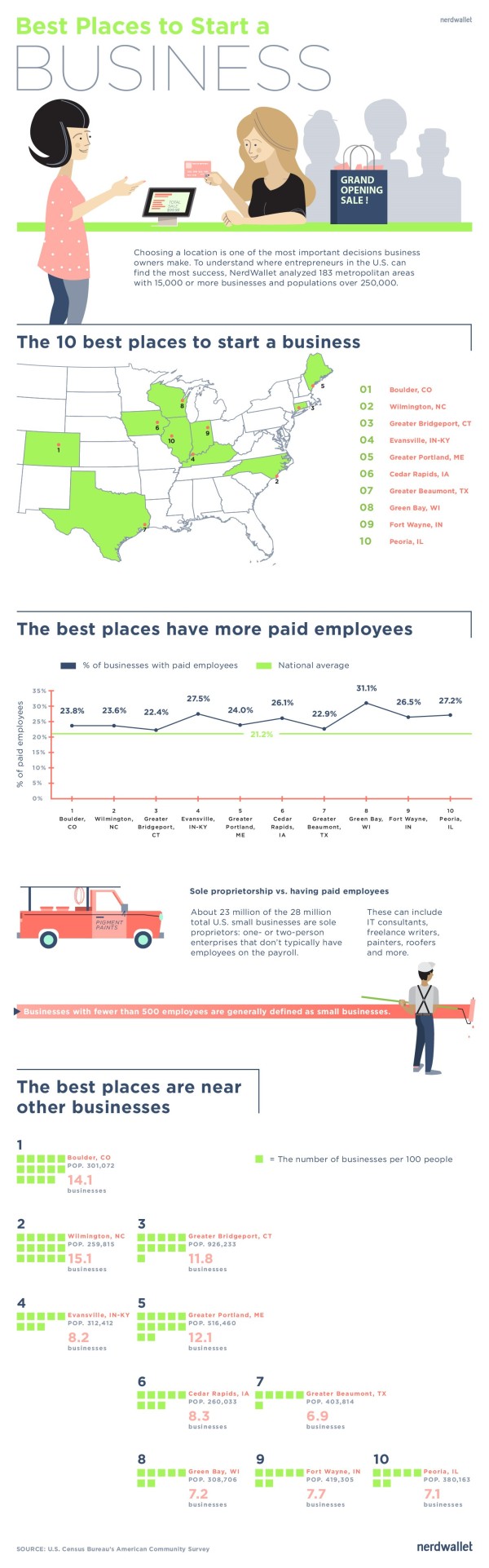

First, NerdWallet analyzed 183 metro areas with at least 15,000 businesses and populations over 250,000. They used six metrics to determine if businesses in the city were successful and if the overall economy of the region is strong.

NerdWallet concluded that smaller cities are better—all the cities on the top 10 list were smaller—with populations under 1 million. Half of the top 10 is in the Midwest, likely due to a lower cost of living and less competition.

The top five metros are:

- Boulder, CO

- Wilmington, NC

- Greater Bridgeport, CT

- Evansville, IN/KY

- Greater Portland, ME

Check out the whole list below, and then check #2 to see if any of those top startup cities are more to your liking.

2) Best Cities for Startup, Part 2

Using a different measurement standard, WalletHub looked at the 150 largest U.S. cities and analyzed the relative start-up opportunities in them. They used 13 key metrics and determined:

| Best Cities to Start a Business | Worst Cities to Start a Business | ||||

| 1 | Shreveport, LA | 141 | Anaheim, CA | ||

| 2 | Tulsa, OK | 142 | San Jose, CA | ||

| 3 | Springfield, MO | 143 | Santa Ana, CA | ||

| 4 | Chattanooga, TN | 144 | Oakland, CA | ||

| 5 | Jackson, MS | 145 | Ontario, CA | ||

| 6 | Sioux Falls, SD | 146 | Fremont, CA | ||

| 7 | Memphis, TN | 147 | Yonkers, NY | ||

| 8 | Augusta, GA | 148 | Garden Grove, CA | ||

| 9 | Greensboro, NC | 149 | Jersey City, NJ | ||

| 10 | Columbus, GA | 150 | Newark, NJ | ||

Obviously here, too, costs count. For instance they found office space is four times more affordable in Toledo, Ohio, than in San Francisco and the cost of living is two times higher in New York than in Laredo, Texas.

But, when examining both lists, it’s obvious that you have to look at more than costs before you call the moving van.

I have to share my personal point of view, city #143, Santa Ana, CA is hopping right now, with new shops and restaurants drawing lots of customers. From all the cities shown, that’s where I’d stake my claim.

3) State of Women-Owned Businesses

The National Association of Women Business Owners (NAWBO) and Web.com just released the 2015 State of Women-Owned Business Report, which shows women business owners (WBO) continue to grow more optimistic about the state of the economy.

What will WBOs invest their money in this year? More than half the women (55 percent) put marketing on the top of their lists. Taking a deeper dive into the numbers, 87 percent of the WBOs say LinkedIn is (by far) their most-valued social media channel, leading Facebook, which came in second at 67 percent.

Marketing tools are key. According to the WBOs surveyed, their top 3 marketing tools are:

- A business website (92 percent)

- Social media presence (77 percent)

- SEO (72 percent)

Having their websites optimized for mobile functionality “represented the most significant increase in the marketing consideration set, trending upwards at 29 percent since 2013.”

The report indicates women “still lack confidence in their ability to design and maintain their business’ website and to employ mobile marketing activities. This isn’t good, since these are, in my view, the two most important ways to market your small business.

What does it take to succeed? It’s a three-way tie, with 95 percent of the women saying passion and optimism for the business idea, the vision to succeed long-term and networking abilities to attract new customers are the key personality traits they need. A risk-taking attitude and willingness to fail are next, both coming in at 92 percent.

4) The Yin and Yang of Small Business

Seven years after the “Great Recession,” 64 percent of small business owners report their businesses are still recovering, says the Bank of America’s spring 2015 Small Business Owner Report.

However, despite this, the entrepreneurs surveyed are still confident about the future growth of their businesses: 63 percent expect revenue to increase in the next 12 months and 66 percent plan to grow in the next five years.

One area of the report that’s particularly interesting is the fact that business owners are ready to hire, yet 41 percent are struggling to find the skilled workers they need. So they’re investing money in training them.

Nearly 40 percent have applied for loans in the past two years, and they plan to use that money to train their employees. Additionally, 46 percent plan to hire new staff.

They’re also treating their current employees well. Almost all (94 percent) say their companies have employee appreciation programs and offer benefits including:

- Flexible hours (56 percent)

- Close office on major holidays (48 percent)

- Paid vacation (46 percent)

- Dinners & outings (46 percent)

- Spot bonuses (44 percent)

- Healthcare (37 percent)

- Office recognition programs (35 percent)

- Extra time off (34 percent)

- Off-cycle raises or promotions (25 percent)

There’s a lot of other good news in the report:

- 63 percent are supporting other small business owners by “shopping small”

- The most optimistic entrepreneurs come from Los Angeles, Dallas, Miami and San Francisco

On the down side, the myth of the always-working entrepreneur is true. According to the report small business owners are working long hours, forgoing raises and delaying their own compensation as they focus on investing in employees and attracting and rewarding repeat customers.

In order to support their businesses, 85 percent of small business owners work more than 40 hours per week and 30 percent work more than 60 hours. (I can relate; I’m writing this at 2 am.)

5) Legal Aid

All entrepreneurs should have a team of professionals they can call on when they need help. While many have accountants there is one area, according to Avvo, an online legal marketplace, they tend to neglect. Avvo says many small business owners think getting legal guidance is a luxury reserved for big businesses.

As part of its National Small Business Week celebration, Avvo is offering a 50 percent discount on Avvo Advisor sessions so small businesses can get big business-type help at small business prices—only $19 for a 15-minute call with a top-reviewed business attorney. The promotion lasts through Friday, May 8th. To get help from an Avvo Advisor use the promo code: SMBIZWK.

A recent survey the company conducted showed that less than 50 percent of small business owners use an attorney to help prevent mishaps. Why?

- 51 percent say attorneys are too expensive.

- 39 percent say it’s finding the right attorney takes too much time

Paradoxically says Nika Kabiri, Avvo’s Director of Consumer Insights, it’s their “optimism bias” that makes many business owners think they’ll never need an attorney.