The checkout line looks a lot different than it did before COVID-19. Cashiers and customers wear masks, plexiglass shields separate us, and using cash has become taboo. As you plan to reopen your business safely, ensure you’re ready to accept a more sanitary method of payment: contactless. Every paying customer is going to have to check out, so the card reader is likely one of the most touched surfaces in your store.

What Are Contactless Payments?

Contactless payments can include mobile wallets such as Apple Pay or Google Pay, or contactless credit or debit cards. Mobile wallets are convenient for shoppers because they can effectively turn almost any credit or debit card into a contactless payment method. Simply enter your payment info into the app and it will store your cards securely. With mobile wallets, shoppers have access to all their saved cards, even if they forgot their wallet at home or want to earn rewards on a specific card but don’t keep it on them all the time. This can help avoid a real-life “abandoned cart” situation, should a customer realize they forgot their physical card.

Mobile payments are considered to be quite secure by experts. Mobile wallets tokenize payment information, meaning the phone never broadcasts your actual card details. Even if a scammer or thief were to intercept a phone’s payment, the information they’d get wouldn’t be very useful.

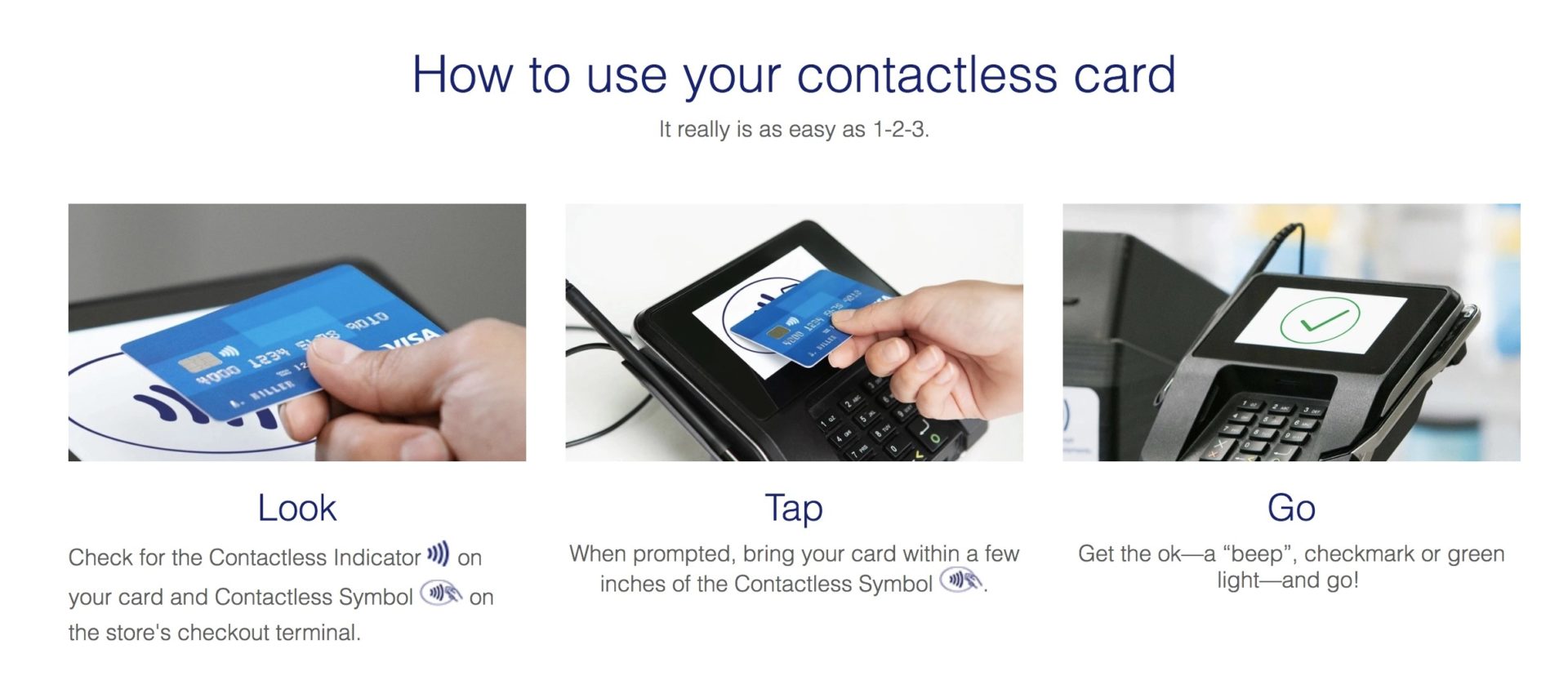

Contactless cards, sometimes called “tap to pay” cards, use an embedded chip to wirelessly transmit payment information. There are a handful of popular contactless credit cards, and local banks may also embrace the technology for their debit cards. If your customer is unsure if their card has this feature, have them look for the Contactless Indicator printed on their card, which looks like a wireless symbol.

Contactless cards have been popular in Europe for years and had been gaining popularity in the U.S. even before the pandemic. The COVID-19 outbreak surely has had an impact on the contactless market. A recent report estimates global adoption rates for contactless cards to be 6 to 8% higher than pre-pandemic levels of growth. With more customers embracing this payment technology, it’s important that your systems are up-to-date and ready to accept it.

Contactless cards have been popular in Europe for years and had been gaining popularity in the U.S. even before the pandemic. The COVID-19 outbreak surely has had an impact on the contactless market. A recent report estimates global adoption rates for contactless cards to be 6 to 8% higher than pre-pandemic levels of growth. With more customers embracing this payment technology, it’s important that your systems are up-to-date and ready to accept it.

If you’ve upgraded your card readers in the last few years to accept EMV chip cards, your machine likely includes NFC and RFID technology, which is required to accept these touch-free payments. Look for stickers or the display screen to indicate that it accepts Apple Pay, Google Pay, or contactless cards.

Why Contactless During The Pandemic? It’s All About Shared Surfaces

In a world where every public surface has now become a possible source of infection, reducing the number of shared surfaces in your store can help keep customers and employees safe. By encouraging contactless payments, whether by smartphone or card, you’ll ideally reduce the number of people touching the card reader’s PIN pad and stylus. If set up correctly, most cards should be able to complete a transaction without any other input to the card reader, such as a PIN or signature. Of course, there are a few exceptions, such as the machine asking if a debit card should be run as debit or credit, and signatures for purchases over a certain dollar amount – this is a security feature. Your point-of-sale may also ask for non-payment inputs, such as a phone number to pull up a rewards account. For the time being, you may be able to reprogram your systems to skip these questions and allow the cashier to enter information on their computer, rather than have the customer use the card reader for such tasks.

Contactless payments can also be processed more quickly than EMV chip transactions, and can therefore help move lines along at a faster pace. This can prove especially useful if you’ve implemented cleaning procedures between customers, which, while key to in-store safety, may force customers to wait longer. Depending on your cleaning policies and procedures, a customer who doesn’t touch the card reader and uses a contactless payment may allow you to skip wiping down the machine after their purchase, further speeding up the checkout line and reducing the wear on your card readers.

Greg Mahnken is a Credit Industry Analyst with Credit Card Insider. He strives to help consumers make responsible credit decisions, regardless of their experience level. Credit Card Insider offers unbiased credit card reviews, a credit insider academy, and blog posts focused on a variety of credit topics.

Image Credit: Visa

Contactless payment stock photo by YAKOBCHUK VIACHESLAV/Shutterstock