By Liz Kulik

In this third of a three-part series on crowdfunding (see Part 1 and Part 2), learn the final steps to take to improve your crowdfunding campaign’s chances of success.

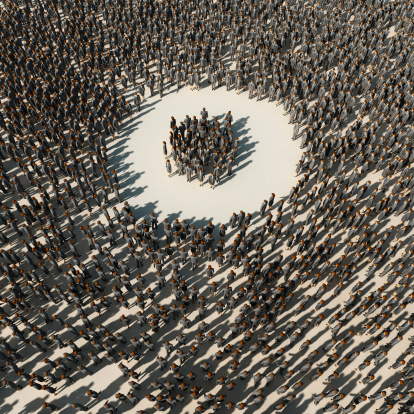

Step 4: Build an early funding community of brand ambassadors before your campaign launch. Crowdfunding requires a serious and steady commitment to social media marketing well before the campaign begins. Funding “from the crowd” almost never occurs unless there is solid support from friends and family backers who contribute at least 30% within the first seven days of the campaign. Campaigns that bring 30% to 40% of their fundraising goals are most likely to meet and surpass their overall crowdfunding goal.

You will need to invest time and effort to develop and execute a quality campaign that is rich in focused content and messaging. A video of your story and product demos, professionalized presentations, and engaging thought leaders in your field through social media channels will help to generate early brand recognition.

Building a funding community of brand ambassadors for your project starts with those friends and family members who believe in you. With early funding validation from family & friends, and a great digital campaign, word of mouth spreads quickly and virally on the Internet, catapulting your campaign through more and more networks.

Coordinating campaign messaging and outreach across all social networking and online Web properties strengthens backers’ confidence in the project and that management will be able to execute the project plan. Be proactive using Facebook and Twitter, not just starting a page and counting your followers every week. Interact with your followers and follow others who could contribute their large networks to your outreach. Provide engaging content, countdowns to fundraising time, and status updates. One of the easiest ways to gain “buzz” is by creating a thought-provoking, visually rich blog. Allow guest bloggers to post on your blog, e.g., if you’re launching a cookbook, allow followers to post their original recipes.

Step 5: Be strategic about the rewards and incentives you offer. Entrepreneurs have never before had the ability to pre-sell products and validate their businesses to customers as they socialize funding needs broadly, quickly and purposefully in a crowdfunding rewards campaign. Adding the JOBS Act Titles to the crowdfinance ladder gives entrepreneurs a unique opportunity to curate a funding community of both accredited and non-accredited who have contributed with no expectation of a financial return.

For those pursuing donation- or rewards-based crowdfunding campaigns, incentive offerings are a campaign cornerstone, with several key strategies to work out prior to launch. A rewards campaign is an opportunity to create an experience for your backers that either connects them personally to your mission or product. People, beyond friends and family, contribute to rewards campaigns to be part of something exciting; the next big tech product, an innovative solution to a pressing social issue, a new local resource that adds value to their communities or lives. The returns expected are simply fulfillment as promised, the results are a community of loyal brand ambassadors if you do, and dissatisfied and vocal customers if you don’t.

With standards emerging from thousands of successful campaigns, ProHatch advises entrepreneurs to design a reward campaign that has a maximum of eight tiers. The highest number of contributions will be in the $50 and under tier, where entrepreneurs can offer an unlimited number of easy to produce and deliver rewards such as thank-you’s and shout-outs ($1-$10), stickers, posters, photos, T-shirts ($10-$25), personalized momentoes or an early beta product if cost appropriate ($25-$50). In these tiers, the goals are to create brand awareness across a wide audience and reach early customers.

The next tiers of “gold” and “platinum” rewards may be increasingly limited in numbers offered to create a sense of exclusivity and excitement that there is something big happening. This gives entrepreneurs an unheard of opportunity to connect personally with major contributors by creating an experience for them around products, events, and their personal connection to the entrepreneur and enterprise success. The higher the dollars requested, the greater the incentive. Use this as an opportunity to include your ultimate customer partner in the future of your enterprise. Launch parties are a great incentive to rub elbows with exciting operating companies, walk-on roles in collateral, operations, and board activities are all ways to create interest from major contributors.

Under every circumstance, consider the impact of the experience you want to create to developing your brand, revenue and sustainability, as well as the costs of production relative to the net gain from funding. It is a disaster when rewards cost more to produce and deliver than the amount from fundraising!

Step 6: Demonstrate your expertise and passion. If you want people to believe in you, you must show them that you believe in yourself and have a comprehensive understanding of your enterprise’s need for funding today and tomorrow. Be transparent about the risks and rewards associated with your enterprise and campaign. Demonstrate your knowledge of the market; validate your management team’s expertise. Most importantly set reasonable and achievable funding goals that work with the networks you can bring and then reach. Infuse your campaign with your own passion for your business and you will make an immediate connection with people who will fund to be part of your story and spread the word to their own extended networks.

Beef up your bios and assemble a team of experts in a variety of fields. Crowdfunding projects that stand out are projects with competent and passionate leadership and that actually have the potential to reach their business goals.

Liz Kulik, founder and CEO of crowdfunding platform ProHatch, has been a leader in the financial services, real estate and business advisory industries. She has created and executed development, acquisitions, dispositions, repositioning and growth strategies for over $75B of institutional operating company and real estate investments.