12 Things Entrepreneurs Need to Know

By Rieva Lesonsky

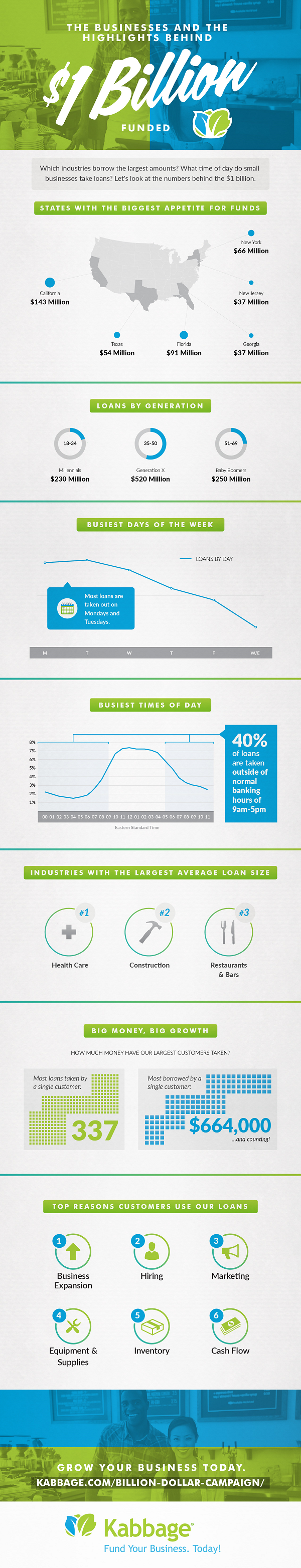

1. Where the Money Flows

Kabbage, a leading provider of online loans for small businesses, just released statistics on which states and industries are getting the most small business loans.

Some highlights:

- California has the “biggest appetite” for loans ($143 million)

- Gen X entrepreneurs are the most likely to get loans, Millennials the least likely

- The top 3 industries (in order of loan size) are healthcare, construction, restaurants/bars

- The #1 reason small business owners apply for loans? Business expansion.

Check out the infographic below for more.

2. Why Consumers Don’t Shop Small

Software Advice just issued a report showing the top reasons consumers stop shopping at small local retail stores. They include:

- Understaffed store (85 percent)

- Out-of-stock merchandise (83 percent)

- Long checkout waits (82 percent)

- Not being recognized as a loyal customer (66 percent)

Software Advice says all these “frustrations could be prevented by a robust POS system.” And yet, according to its study, 64 percent of retailers weren’t using such a system.

If you’re one of those companies, check out Software Advice’s new guide which will help you identify the “5 Must-Have Features” to look for when evaluating POS systems.

HR Solutions (#s 3-5)

3. Simplify Your HR

Small businesses today need easy-to-use solutions for hiring and onboarding employees and managing the increasing complex world of HR compliance. Flock (which just announced it got $2 million in seed funding) offers a technology platform to help you do just that. You can also manage benefits online without disrupting the personalized and highly specialized services in place from existing insurance brokers.

The Flock platform, which can be set-up in just minutes, was designed to work with the benefit brokers and general agents whom HR and SMBs already trust to navigate the complicated world of healthcare insurance.

Raj Singh, Flock’s CEO says, “Employee engagement has never been more important to small businesses. [Flock’s platform] provides a paperless and automated system for the painful, but very important administrative tasks required to onboard and continuously manage employees. Flock limits risks and liability resulting from ever-changing health care legislation; we make it easier for HR and brokers/agents alike to be the strategic drivers and champions for their HR and business counterparts.”

The really good news is Flock’s platform is completely free for SMBs and available to brokers for a fee.

4. Hiring Made Easier

As most small business owners know, it’s hard and time consuming to stay on top of all the rules, regulations and employment laws that rapidly change at the county, city, state and federal levels. And since most small businesses don’t have an internal HR team to help navigate the process, all too often they’re unaware of or misinterpret laws.

The hiring process alone can be fraught with traps. To ease the hiring process, Chris Dyer, founder and CEO of PeopleG2, offers three essential points:

- Hiring: Do your homework! You have an open position to fill but before you start the interviewing and hiring process you need to check local employment laws. With the flurry of class action laws, which, according to the Consumer Financial Protection Bureau (CFPB), rose 26.8 percent in the last year, proper disclosures are imperative and legally required based on the Fair Credit Reporting Act (FCRA). In addition to proper disclosures, a handful of cities and states prohibit conducting consumer credit checks, background checks, criminal history questions and more.

- Interviewing: Keep it safe. Once the application and interview process has started, security must be a priority. As you collect the applicant’s information, (including personal information such as social security number, credit history, drug tests, etc.) you must handle all of this data correctly. This isn’t limited to locking a filing cabinet full of applications. Take proper care to ensure the data is secure via all transmissions. If you outsource HR be sure to occasionally audit your vendor’s securities practices. In addition, the handling of the applicant is very important—be sure to communicate with applicants correctly, be aware of compliance requirements and practice timeliness when communicating.

- Onboarding: The position’s filled, (or not), now what? There are discrepancies on who handles what documents. A team manager can see some content on the candidate including work experience but they don’t legally have access to some of the applicant’s personal data. If you hire someone, proper documentation for onboarding is important and records of all of the applicant’s documents must be kept for a certain amount of time, dictated by local laws. If a background check is run and the candidate is not hired there are requirements for adverse action documentation in addition to keeping the background documents on file for a required amount of time.

5. Counter-Offers: 4 Steps to Know When to Fight or Pass

Speaking of tough HR decisions, what do you do when one of your valued employees announces they’re leaving? Should you make a counter-offer?

Here’s some insight from Ian Cook, the Director of Product Management at Visier:

According to industry standards, it typically costs 1.5X an employee’s annual base pay to fill the vacant position when he or she chooses to leave. On the other hand, giving raises when they are not warranted will lead to pointed questions from the executive team. Managers and HR executives are faced with difficult decisions such as this on a daily basis.

When facing the decision to counter-offer or not, a flood of questions come into consideration: How is his/her performance? Has he/she had enough time or opportunities to prove him/herself? What is his/her future potential?

Instead of making the decision based on a “gut feeling” or treating it like a high-stakes poker game, managers need to act based on an analysis of the data at hand, such as the employee’s detailed work records and performance ratings compared to peers and other employee groups.

Here are four steps to dramatically help increase your chances of keeping the right talent—at the right price.

Step 1. Make comparisons to peers and employee groups

It’s important to compare the employee’s salary against the earnings of his or her peers and employee groups while taking job performance into account. This helps to determine if the employee is being appropriately compensated. When evaluating this metric, consider making the following comparisons:

- Direct peers: The first and most relevant comparison is to the people with similar roles, levels and geographies. Comparing with similar employees can point out if a person’s situation is unique.

- Employee groups: In addition to direct peers, measure if the employee is above or below the median among peers. For example, if she is below the median on pay and above the median on performance for the group, then the data suggests he/she is worth countering.

- Across the business: Finally, compare the individual to people who have similar roles, but across varying functions. This comparison shows how well he/she is being compensated within his/her existing pay grade and can set precedence for compensation levels.

If, after analyzing the above areas, it’s determined that the employee is worth more, then a counter-offer may be appropriate.

Step 2. Assess the employee’s current and potential value

Once fairness of pay has been established, the next step is to consider what the employee is worth to the company. Consider these key points:

- Performance potential: According to McKinsey’s War for Talent study, top talent employees generate 40 percent more productivity, 49 percent more profit and 67 percent more revenue. Managers should look at an employee’s results overtime and ratings to gauge future value/potential.

- Tenure: An employee’s length of employment is also a key indicator to determine his/her value. Long service and steady or declining performance may indicate a career plateau and need for change.

- Potential future value: Review an employee’s promotion history to see if he/she has potential to grow and take on higher positions. Keep in mind, external hires make 18 percent more than internal promotions in the same job.

Step 3. Determine the consequences

If you’re still not sold on making a counter-offer, your decision may be further swayed by evaluating the consequences, such as cultural impact, morale and more, if the employee [were to leave]. It is also important to consider:

- What will it take to replace the employee?

- How long did it take to fill her position in the past?

- How many junior people are ready to move in to her role?

- What is the likely ramp-up time for someone new into this role?

If the employee is relatively easy to replace and [their departure] will not have a significant impact on the existing team, then the counter-offer is less impactful in the long-term. If the consequences out-weigh the benefits, then it may be time to negotiate.

Step 4. Put it all together

Last, it’s important to pull together all of the considerations and take a look at the whole picture before making a final decision. If all signs—compensation, performance, future value and replacement costs—indicate a counter-offer, the manager then needs to prepare an attractive package that will incentivize the employee to stay. Sample counter-offer packages can include:

- Incremental pay increases per year based on performance

- Additional bonus possibilities when certain goals are attained

- Retention bonuses over a two-year time frame to compensate for delayed career progression or similar situation

- Benefits such as flexible working arrangements, added paid time off and more

- Non-monetary benefits such as development opportunities

As a general rule, make sure to add up all the tangible and intangible compensation items as well—like health benefits—to truly make the counter-offer package stand out.

Counter-offers are no doubt a hard decision to make. By taking a look at the employee’s current and future value as well as considering the overall effects on the company can help paint a clear picture of the situation. Then, assessing these data points can help develop an effective counter-offer strategy.

6. Click-to-Call: Engine of the Mobile Economy

We all know mobile technology has changed the way we buy products and services. Independent data just released from Marchex, a mobile advertising analytics company, forecasts that “click-to-call commerce” will contribute to more than $1 trillion in consumer purchases this year. The study also reveals consumers who “click-to-call” directly from a mobile advertisement are four times more likely to purchase a product or service than a consumer who interacts with an online ad.

The study shows consumers will call businesses directly from mobile publishers and apps more than 93 billion times this year, and that many of those phone calls will result in an appointment, reservation, in-store purchase or over-the-phone sale.

Among the survey findings:

- Across more than a dozen industries, including insurance, travel, auto repair, legal services and home improvement, 5-25 percent of phone calls from mobile ads convert into sales, appointments or reservations

- On average, a “click-to-call” from a mobile consumer is 4 times more likely to become a paying customer than a consumer clicking to a Web page from an online ad

- Robocalls are a major challenge for click-to-call marketers, and issues vary by severity across mobile publishers. Marketers require analytics-based solutions to measure media efficiency

- Millennials are the most likely to “click-to-call” of any age group, and should be the target of mobile click-to-call campaigns

You can download a copy of the whitepaper, 2015 Click-to-Call Commerce Report, which is the latest report from the Marchex Institute.

7. Ensuring Data Privacy

Pitney Bowes estimates that more than 85 percent of SMBs aren’t providing the baseline level of data privacy protections for their transactional communications with clients—bills, statements, patient records, etc. Given the millions of checks, statements, insurance notices, healthcare records and other sensitive and private documents mailed or emailed every day by these businesses, they need to apply the highest levels of privacy safeguards possible.

To help, Pitney Bowes (disclosure, a client of our company) just launched Relay, a multi-channel communications suite designed specifically for small and medium businesses to enhance their transactional communications (bills and statements), while providing for client data privacy and meeting growing regulatory requirements and complexity.

At the heart of the suite is the Relay communications hub, a cloud-based digital document hub that helps businesses create more accurate and impactful communications, direct in-house or off-site production, and deliver communications through physical or digital channels, including email, post to web, and digital archiving. The hub also offers off-site production options in the event of a business disruption or to alleviate capacity overflows.

This new cloud-enabled platform helps SMBs:

- Ensure client data privacy

- Meet growing regulatory requirements

- Help SMBs integrate their physical and digital transactional communications to meet client preferences

The Relay multi-channel communications suite features the new Relay inserter series, which offers the latest barcode technology to optimize accuracy and document integrity.

“Businesses spend billions of dollars annually to protect client data, both in physical and digital formats,” says Patrick Brand, senior vice president & general manager, Global SMB Products and Strategy at Pitney Bowes. “Yet, when it comes to sensitive client data in the mail, the same high level of privacy protection was exclusive to large, enterprise mailers. When you consider the millions of checks, bank statements, insurance notices, healthcare records and other sensitive documents mailed every day, businesses of all sizes need to apply the highest levels of privacy safeguards possible.”

8. Increase Your Chances of Success

A new report from Babson College shows small business owners who complete the educational component of the Goldman Sachs 10,000 Small Businesses program grow their revenue and create jobs at rates that outperform the broader economy. (Disclosure: My company is a client of the Los Angeles Goldman Sachs 10,000 Small Businesses program.)

Kerry Healey, President of Babson College, which is the academic partner of 10,000 Small Businesses says the report, Stimulating Small Business Growth: Progress Report on Goldman Sachs 10,000 Small Businesses, shows, “In just 18 months after completing the program, 76 percent of program graduates increased their revenues and 57.1 percent created new jobs.” Healey attributes that to “The growth oriented, practical, peer-to-peer driven classroom experience, together with business support services, drive participants to change their attitudes and business practices, helping them to achieve significant growth; growth that is critically important to strengthening the U.S. economy.”

Some key findings:

Of the 10,000 Small Businesses graduates:

- 67 percent increased revenues six months after graduating, which rises to 76 percent after 18 months, compared to 45 percent of U.S. small businesses overall

- 46 percent created net new jobs six months after graduating, which rises to 57 percent after 18 months, compared to 22 percent of small businesses overall

The program maintains a 99 percent graduation rate and fosters a marketplace where 84 percent of graduates do business together. 10,000 Small Businesses mainly serves mature businesses, looking to grow to the next level. The typical business comes into the program with $692,000 in revenues, 11 employees and has been in business 11 years.

Babson College has trained more than 200 faculty and staff to deliver the program primarily at community colleges throughout the United States, and through a national blended-learning program. Participating businesses are at least two years old and employ a minimum of four employees.

You can apply for the 10,000 Small Businesses business and management education program here.

9. Entrepreneurs Go Mobile

According to Manta’s SMB Wellness Index about 80 percent of small business owners use their mobile phones for business at least once a day. And 25 percent use their mobile devices for business at least every hour. Don’t think all this mobile activity happens when entrepreneurs are on the road. In fact, 78 percent use their mobile devices while sitting in front of their computers.

Why are entrepreneurs increasingly turning to mobile?

- Communicating with customers (56 percent)

- Checking personal texts or email (48 percent)

- Creating notes or to-do lists (30 percent)

- Speedier email access (25 percent)

- Banking (24 percent)

Depending on how you look at it apps-enabled smartphones allow small business owners to mix work and pleasure: 78 percent check work email or other documents while on vacation. Most (64 percent) say mobile access allows them to enjoy their vacations more, but 36 percent believe it takes away from enjoying their break.

Not everyone is lucky enough to get away. Only 43 percent of those surveyed take vacations; 29 percent don’t have anyone to cover their responsibilities while they’re gone; 24 percent can’t afford to take a vacation or the loss of income (21 percent) that would result from time off. Finally, 12 percent simply don’t trust anyone else to run their businesses while they’re gone—so they don’t go anywhere.

2015 has been a successful year so far for 71 percent of the small business owners and 82 percent are optimistic about the rest of the year.

10. 5G is Coming

There’s been a lot of speculation about 5G and what impact it will have. To learn more InterDigital just released a global survey of mobile network operators.

Bringing a new generation of wireless technology to the mainstream is a colossal undertaking. The survey was conducted by Heavy Reading in partnership with the Telecommunications Industry Association (TIA). The resulting whitepaper shows the mobile operators’ expectations for future 5G networks and services. InterDigital says, “The intention [of the whitepaper] is to provide guidance to the industry and other stakeholders on spectrum, technology, timelines, and potential 5G services. “

Among the key findings:

- The primary drivers for 5G are better broadband performance (76 percent) and the Internet of Things (74 percent).

- Most operators (74 percent) expect 5G will require a substantially different system architecture

- 71 percent think Asia will lead 5G development and deployment

- 33 percent expect their company will launch a commercial service by 2021

- Operators expect more overlap between 4G and 5G services than between 4G and 5G technologies

Cool Tools

11. Track Real-Time Sales Data on the Go

Being a business owner means you’re constantly on the move. You rarely have time to sit down, let alone sit at your computer to check how your business is going. But you can’t ignore the need to know that crucial information either. Square reports that more than 70 percent of larger businesses taking payments with Square use Square’s analytics on a daily basis.

Now the company’s made it even easier to get the information you need about your small business, “when you need it, wherever you are.” The Square Dashboard app offers real-time data about what’s going on in your business—straight from your mobile device. In an instant and with just a tap, you can get insight into what’s running smoothly and what needs to be looked at.

The app allows you to see:

- Your sales in real time as they’re happening

- Your sales summaries: You can check sales, the number of items sold, and the average sale amounts each day.

- Sales comparisons: Compare your sales to last week, last month, or last year. This information helps you figure out when to staff up or down.

- Which items are your best sellers: You can instantly spot which categories are doing well, and which might need some TLC with a sale or a promotion.

- If you have multiple locations, you can see how all your locations are doing. You can choose to see sales data at one location, select locations or all of them.

The Dashboard app is compatible with iOS 7 and iOS 8 and is available for download in the App Store. And it’s free.

12. Is Your Bank Socially Responsible?

The American Bankers Association Foundation has announced the launch of a corporate social responsibility tool—a new interactive map, Banks in their Communities, which showcases corporate social responsibility programs from banks across the country.

The map, allows users to search and view bank programs in categories, including:

- Affordable housing

- Community and economic development

- Financial education

- Nontraditional borrower and underbanked

- Protecting older Americans

- Volunteerism