Programs

Helping B2Bs

Alibaba.com has expanded its B2B program to help small businesses through these challenging times. B2BToday offers articles and tips to inform and inspire you, interactive virtual events (every Tuesday) and virtual office hours where business owners can have One-on-one conversations with experts to get more personalized solutions (on Thursdays).

Next Tuesday, April 28 from 3-4 PM ET, join their fireside chat and get insight from Elizabeth Vazquez, CEO and cofounder of WEConnect, on the benefits of certifying your business as a diverse-owned enterprise.

Register for this free event now.

Small Business Webinar Series

Verizon launched a Small Business Webinar Series earlier this month, featuring experts who will share practical advice, insight and tips on how small businesses can survive during these unprecedented times.

Register for the free webinars. On Tuesday, April 28 at 2 PM ET, Anita Campbell, founder of SmallBusinessTrends, will talk about helping your remote teams stay productive.

Ramon Ray and I will discuss keeping your business operating effectively in the new normal, on Thursday, April 30, also at 2 PM ET.

Tools to Help Small Businesses Navigate Federal Programs

ADP, a leading global technology company providing human capital management (HCM) solutions, is working with the federal government to support businesses and their employees in securing timely relief to help mitigate the impact of the ongoing COVID-19 pandemic.

ADP has focused on providing information and tools to help their clients understand and navigate the legislative relief (the FFCRA and the CARES Act) that has been adopted over the past few weeks. Their newly developed tool set includes:

- ADP Employer Preparedness Toolkit: From resources on legislation updates such as the CARES Act and FFCRA, to insight on how to manage and engage a remote workforce, the toolkit consists of wealth of information in the form of webinars, articles, checklists, FAQs and more to help guide efforts and decision-making.

- Paycheck Protection Programing: Includes information on how to apply for PPP and more information on legislation relief for businesses.

- ADP Employment Tax Guide: To help companies with information specific to their state, including agency status updates in response to COVID-19.

- Resources for Accounting Professionals: Aid to accounting professionals, to help best support their clients in light of recent and ongoing legislative changes.

- COVID-19 Small Business Resource Center: Includes a variety of resources including local and state guidance, webcasts, FAQs and more, all specific to SMBs.

Can You Help Solve Business Challenges?

Act quickly on this competition—deadline for submissions is April 30.

The Visa Everywhere Initiative is a global, open innovation program inviting startups and fintechs to solve the payment and commerce challenges of tomorrow, further enhancing their own product propositions and providing visionary solutions for Visa’s vast network of partners.

The program, which first launched in the U.S. in 2015, quickly expanded globally and has more than 6000+ participating startups. To date, the startups have collectively raised over $2.5 billion in funding.

As COVID-19 continues to take a human and economic toll across the world, there is a need to find immediate solutions to help rebuild small businesses. VEI is inviting fintechs and startups to submit a solution that will support small businesses recovering from the economic impact of the Coronavirus. The startup that submits a winning solution will be awarded $50,000.

Right now, Visa has six open VEI challenges – one which directly addresses COVID-19 relief – for an opportunity to win $150,000 in prizes. The winner of the COVID challenge will win $50,000 and other prizes will be distributed among other challenge winners. Submissions are open until April 30th. More details on all the challenges and how to submit your application can be found here.

Explaining Funding Options

To help make sense of the various programs available, Become launched a portal dedicated to answering the questions small businesses may have. The comprehensive guide outlines the funding options available (including who qualifies), and links directly to the applications, to make the process as easy and straightforward as possible.

Crisis Communication Templates

10 crisis communication plan templates. Venngage has created a package of crisis communication and management plan templates—and they’re all free.

Free E-Commerce Hosting

Volusion just launched Curbside—a new program offering a year of free e-commerce hosting, payments, and pickup/delivery to affected brick-and-mortar establishments. Using Curbside helps cut out the fees associated with the established delivery services letting business owners keep more of their profits while serving their communities.

More details can be found in this blog post.

Polls & Surveys

CARES Act Relief Status

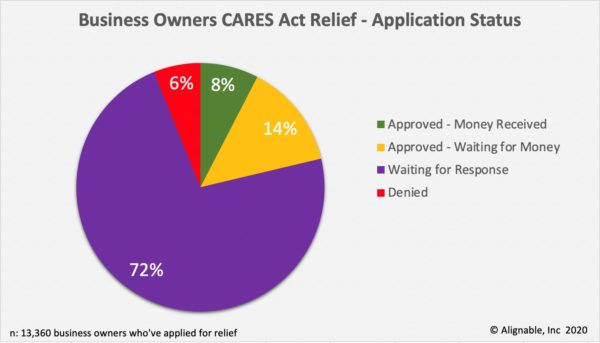

The latest Pulse Poll from Alignable shows only 8% of small businesses have received money, and another 14% were approved for it, but aren’t sure when or if it’s coming from the CARES Act. Plus, 72% who applied for the loans haven’t yet been approved. They’re in a state of limbo, not sure if they’ll ever see the money they were counting on to weather the Coronavirus quarantines.

“There’s no excuse for banks keeping 72% of business owners in the dark for weeks on end,” says Alignable’s cofounder and CEO Eric Groves. “According to senior SBA officials, the approval process is instantaneous upon submission of a completed application. So, why aren’t banks coming clean with their customers? It’s a question we’re going to dive deeper into in the weeks to come.”

“There’s no excuse for banks keeping 72% of business owners in the dark for weeks on end,” says Alignable’s cofounder and CEO Eric Groves. “According to senior SBA officials, the approval process is instantaneous upon submission of a completed application. So, why aren’t banks coming clean with their customers? It’s a question we’re going to dive deeper into in the weeks to come.”

“The need for this funding is great and becoming more pronounced as the days and weeks go by,” adds Venkat Krishnamurthy, Alignable’s cofounder and President. “And 45% of the businesses polled have been forced to shut their doors already.”

The current impact of the quarantines is staggering with 98% of small business owners saying their revenues have dropped by at least 25%, and 47% saying they’ve already lost half their revenue due to COVID-19.

SMBs Say They’ll Regain Lost Momentum

Vistage just released survey data, revealing how SMB CEOs are dealing with the crisis caused by the Coronavirus pandemic. One highlight—84% were planning on leveraging the Paycheck Protection Program.

Other key points

Employment

- 37% expect their total number of employees to decrease in the next 12 months

Business Health

- 49% think their businesses will be moderately weakened but regain momentum in six months

- 21% believe their businesses will be stronger than before in six months

- 16% believe things will be back to normal in six months

- 38% say they’ve changed products or services as a result of the pandemic

- 54% predict their firms’ fixed investment expenditures will decrease in the next six months

Cash Reserves and Financial Assistance

- 31% have cash reserves to support their businesses for 3-5 months

- 20% only have cash reserves for 1-2 months

SMBs are Resilient

TriNet and The Harris Poll released a survey showing that despite the current economic environment and the difficult decisions being made, SMBs were optimistic—80% of polled companies have made strategic investments to keep their businesses operational through the pandemic, and 76% of those who have made investments are confident these investments will pay off after COVID-19. Plus, 65% believe the U.S. economy will recover in a year.

While SMBs are confident they can weather the storm in the near future—96% were confident that under current circumstances, their business can survive 1 month and 92% were confident t they could last 3 months. But confidence levels begin to slip at the 6 and 12 month time frame.

Revenue is already down for 78% of the SMBs responding:

- 4 in 10 don’t have the cash reserves to last longer than 3 months without help

- 31% can last more than 6 months

- SMBs are trying to control their costs:

- 67% have reduced payroll costs (including 40% taking a reduced salary for themselves)

- 54% have made changes to their business model or product / service offerings since the crisis began

- 48% have applied for financial support through the CARES Act

The business owners are aware of the government programs like the CARES Act and Paycheck Protection Program (PPP), but many don’t know what they provide. Half of respondents say aspects of the program are confusing, especially the tax implications.

- 95% are aware of the CARES Act overall

- 83% are aware of the Paycheck Protection Program

- 54% plan to take advantage of funding

- 27% aren’t sure if they are eligible, or don’t yet know enough about the program to say if they plan to apply

- By April 6, 4 in 10 had tried to apply for funding, and 1 in 5 of those were unable to complete the process

- 6 in 10 think l the loans are ‘difficult to access’

In order to adapt to the current situation, SMBs are making strategic operational choices, including cutting costs, in order to invest in the long-term success of their business. They’re spending less on:

- 46% have reduced employee hours

- 40% of business leaders have taken a lower salary for themselves

- 34% have reduced marketing/advertising spend

- 32% have worked with creditors to reduce obligations

- 29% have cancelled services

- 26% have laid off employees

- 19% have reduced inventory

- 13% have furloughed employees

SMBs are strategically investing in infrastructure, employees, and customers and community. The 78% of SMBs who have made strategic investments focused on:

- Infrastructure: 46% invested in increased infrastructure to be more virtual, online, or contact-less

- Employees: 37% still offer health insurance benefits to laid off or furloughed employees; 37% are paying employees who are not currently working

- Customers and community: 37% donate to or sponsor local causes for COVID-19 relief (15% are donating to national relief); 36% offer assistance to customers (such as free services, discounts, delayed/forgiven payments, waiving fees, etc.); 14% increased their marketing / advertising spend

You can learn more from TriNet’s ongoing webinar series and blog series. All this information is also housed in the COVID-19: TriNet Business Resiliency & Preparedness Center.

Remote Working

More U.S. employees are working remotely than ever before. A new survey from Clutch found 66% of employees are working from home as a result of the COVID-19 pandemic, including 44% who are working remotely 5 days or more per week. Only 17% of employees worked remotely 5 days or more per week before the pandemic.

The pros & cons of working remotely:

The top three benefits of working from home

No commute (47%), more flexible schedule (43%), and not having to dress up (33%).

The top three challenges of working from home

Collaborating with colleagues (33%), interruptions and distractions (27%), and sticking to a routine (26%).

The Negative Impact of the Coronavirus

A new survey from Next Insurance shows 89% of small businesses expect to be negatively impacted by the COVID-19 pandemic, with 59% having already experienced losses.

Additional findings

- 41% of small businesses have already started cutting expenses

- 34% of small businesses believe they are adequately prepared for this crisis

- 26% have already put their business completely on hold

- You can read more on their blog.

Get Informed—Webinars

Bluehost

Bluehost brought together several small business owners in a State of Small Business webinar to share what has worked for them and provide advice and valuable insights including:

- E-commerce options to transition the business online

- Offering virtual consultations and services through online meetings

- Updating business plans or pricing to accommodate WFH methodologies

- Creating virtual events such as webinars or “non-event” events including contests

The Jesse Lewis Choose Love Movement™

The Jesse Lewis Choose Love Movement launched a free three-part web series, Navigating the New Normal, to “teach essential life skills needed to adjust to the disruption in the workforce.” The new program, Choose Love For The Workplace™, provides social and emotional intelligence for business leaders and employees.

The series covers:

Part 1—A Time for Courage

The pandemic plays into our instinctual fear. Our lives have been upended. We have no control over the changes affecting our lives and having no control is a bad feeling. Learn how you can brave the pandemic and take your personal power back.

Part 2—The After Effects of Coronavirus

Life after the Coronavirus will never be the same. How can you be resilient and even grow through difficult times. Learn about Post Traumatic Growth and how you can learn from this experience and come out stronger.

Part 3—The Choose Love Formula – April 29 at noon ET

Learn a formula that will help you cope with the drastic changes in your work life and personal life. Applying courage, gratitude, forgiveness and compassion-in-action in your daily life will not only help you through this difficult time but help you thrive.

You can register in advance for part 3 and listen to parts 1 and 2.

Get Informed—Read This

Finder.com has put together tips on how to increase your cash flow and manage your finances during these tough times.

VersaCloudERP launched a Covid-19 Global Resource Center.

- Business resources—U.S.

- Business resources—Canada

Get Informed—Advice

5 Tips for Keeping Consumers Better Informed

From Google for Small Business

Update business hours: If a business is operating with reduced or shifted hours, they can update them on their Business Profile through Google My Business so that customers know exactly when they are able to reach them. Pro tip: double check your phone number is correct and turn on messaging to make sure customers can reach you!

Share a COVID-19 update: Since every business’s response to coronavirus is unique, Google has introduced COVID-19 posts – featured prominently in a carousel on the merchant’s Business Profile in Search (and coming soon to Maps) – where businesses can tell their customers about how their operations and services have shifted. Updates can include safety precautions they’re taking, information about what products and services are available, and whether customers can expect delays.

Showcase business attributes: Given many restaurants and retail shops have closed their doors to patrons but are still operating in other capacities, merchants in the dining and shopping verticals can now update their Business Profiles to inform customers about service availability. Restaurants can add “takeout,” “delivery” and/or “curbside pickup” attributes and mark that they’re unavailable for “dine-in,” while retail stores will soon be able to add “curbside pickup,” “in-store pickup” and/or “same day delivery.” The business operations will prominently appear on merchants’ Business Profiles on Google Search and Maps results when customers look for the business.

Share inventory online: With many shortages on groceries and home essentials, people have to make important decisions about when to leave the home to purchase critical goods. Pointy, now part of Google, helps merchants get their inventory online by connecting information from the merchant’s Point of Sale systems to their Business Profile. For a limited time, Pointy is available for free to select grocery stores, pharmacies and convenience stores in the US. Check if your store is eligible.

Mark a location “Temporarily closed”: Google has made it easier for businesses to mark themselves as temporarily closed directly from Google My Business should they be shutting their doors for a limited time. Note: If a business is marked as temporarily closed, it will be treated similarly to open businesses and will not affect local search rank.

Check out Google’s COVID-19 SMB Resource Hub for more helpful tips and tricks for guiding a business through this challenging time.

5 Business Tips Post-COVID from A PR & Marketing CEO

By Pete Reis Campbell, CEO and founder of Kaizen, a London-based growth marketing agency

As a business owner, the prospect of a pandemic that affects many global economies and potentially the day-to-day running of your business can feel daunting. It can be tricky to know how, and where, to lead your business.

Here’s how to successfully manage your clients during COVID-19 and how to protect your team.

- Be there for your team: Your employees are the most important part of your business. It’s important to recognize they are likely to feel anxious during this time. Respect that you might see a dip in productivity whilst employees find their feet with this new way of working.

For businesses that have moved to remote working during the pandemic, communication is more important now than it ever has been. Be over the top with it. This means more video calls, more meetings, and more contact. Consider introducing more chances for team check-ins and let them know you’re readily available for a ‘virtual tea’ or to answer any questions they might have.

Slack is a great communication platform that allows everyone in your company to converse throughout the day. This becomes more than just the general running of projects, but a space to encourage employees to share highlights of the week. For us, this can be any activity from beautiful design work to top-tier media placements.

- Put steps and a POA in place: If you haven’t already, it’s time to consider how COVID-19 is affecting your business and what you can do to reduce the negative impact. Your plan of action can be split into 3 manageable steps:

Reduce costs: Once Coronavirus picked up, we went through all costs line by line to remove unnecessary cash loss. From software providers to fruit deliveries, this is the time to renegotiate with your suppliers. Reach out to all of your suppliers and see if you can obtain a deferral, a payment holiday or a reduction in overall cost. The more money you can scrape back during this time, the better.

Taking advantage of the employee furlough scheme: Do all you can to protect your staff. If you need to, lean on the scheme to cover employee costs and for job reassurance. This can be a lifeline for very small businesses that may see lower cashflow during COVID.

Reconfigure and reconstruct your business to cover any losses: If business did get worse, how can you operate at a reduced capacity? Work this out in your business so you know how to act if the worst did happen.

Do right by your employees and look at all three of those plans. A well-prepped business owner has to look at the worst and the best scenario.

- Give your clients options: Like us, our clients are often business owners. They share the same uncertainty and anxieties post-COVID. With this in mind, consider what you, as a business, can do to continue delivering great work during this time.

Every client has a different culture and this pandemic has made that clear across our own client base. For example, one of our motoring insurance clients has wanted to increase their budget and do more work. A number of our travel clients have wanted to defer or stop work completely.

In the PR and marketing world, we came up with 4 different options: pause work, carry on like normal, do less work or do more work. Check-in with your client first to see how they’re coping and what they’ve done already before offering those 4 options.

- Stick to your original goal: Simply, there was a reason you started. Remember your business ethos and goals throughout this time. There will be an end to this period and normality will return.

- Remember the importance of a rainy day fund: This pot should cover at least 2 months’ worth of wages and running costs. My accountant advised me to do this early on.

If this wasn’t achievable for your business pre-COVID, be sure to begin working towards having this money in the bank after the pandemic. Agencies, in particular, will always face the challenge of cash flow – regardless of COVID-19. Having the rainy day fund to hand can help ease your own anxieties and protect your business in the long run.

Fighting Business Disruption

By Joe Pascaretta, General Manager of Credibility at Dun & Bradstreet

According to recent research by Dun & Bradstreet and Pepperdine University, 51% of respondents expected working capital fluctuations over the next six months while 18% said that if they were unsuccessful in securing financing within the next six months, they would be forced to sell the business’s assets or shut down.

As small businesses attempt to cover costs and protect their companies, I want to share some tips for business owners to help safeguard against cash flow shortages and on-going market fluctuations, as well as plan ahead as disruptions persist.

Take Action Now

Prioritize Your Employees. Your customers are your bread and butter, but your employees are your frontline. Make sure they have the resources they need to take care of themselves and your company. I had to get creative with figuring out ways to cover my costs, and it was scary, but taking care of my people saved my business.

Hire Responsibly. Make sure that you’re hiring within your means during this time. This ties back to prioritizing your employees; you want to make sure you can take care of all the people who take care of your business.

Stay Insured. While it’s always important to pay your bills on time and in full, if that is not possible due to circumstances out of your control, at the bare minimum make sure that you don’t lapse on your insurance payments. If anything happens that could compromise your business further, you will at least know that you’re insured and won’t have to go out of pocket to cover unexpected expenses related to an accident or disaster.

Be Flexible with How You Accept Payments. By expanding how you accept payments, you can give your customers flexibility with how they’re able to make good on their contracts with you.

Try to Avoid Unnecessary Purchases. If your business is affected, you’ll need any extra flexibility around cash flow you can muster. If you can hold off on making large purchases until you know you’ve weathered the storm, I strongly recommend it. Every business is different, so you’ll know what you need to keep the doors open and what can wait.

Start Planning Ahead

Establish an emergency fund. It is essential to have an emergency fund in place for unexpected circumstances. For example, suppose one of your major suppliers is impacted by unforeseen events. Do you have enough cash stored away to make up for losses coming from a supply chain interruption? While building this fund may seem like an arduous task, especially when you’d rather be investing that money back in your business, it can be well worth it in the long run.

Don’t put all your eggs in one basket. Sometimes it’s tempting to maintain status quo when your business has one or two major clients who support your operations, or when all or most of your clients are in the same industry. However, if anything affected those major clients or that industry, it could cause extreme hardship for your company or even put you out of business for good. Consider diversifying your client portfolio the same way you would your stock portfolio.

Build and maintain a positive credit history. If your company is unable to provide to your clients and needs to take out a line of credit to assist with loss of income, a strong business credit profile can help. A positive business credit report and a good history of making payments on time may help you ease the blow if your business is affected by unforeseen events. Using your strong business credit, you may be able to renegotiate terms with your creditors to help avoid late payments.

Giving Back

Helping the WHO

The Alibaba Foundation, the charitable foundation funded by Alibaba Group, and the Jack Ma Foundation, established by Jack Ma, Alibaba’s founder donated 100 million face masks, 1 million N95 masks and 1 million test kits to the World Health Organization (WHO) to support its ongoing fight against the Covid-19 pandemic. The WHO will receive the medical supplies in the coming days and distribute the supplies to the countries and regions in urgent need.

This donation to the WHO is the latest effort by the Alibaba Foundation and Jack Ma Foundation to support the global fight against the Covid-19 pandemic. Since February, the Foundations have sourced and delivered various types of medical supplies to over 150 countries and regions across Africa, Asia, Europe, the Middle East, North America and South America.

Last week, the WHO, the African Union and United Nations World Food Programme announced a United Nations “Solidarity Flight” which provided a large quantity of medical and personal protective equipment donated by the Jack Ma Foundation and Alibaba Foundation to all countries in Africa.

The WHO also previously supported the distribution of the first and second donations of medical supplies from the Jack Ma Foundation and Alibaba Foundation to the 54 countries of Africa. These supplies were also transported with the help of Prime Minister Abiy Ahmed of Ethiopia and the Ethiopian Government, Africa Centres for Disease Control and Prevention (Africa CDC), World Food Programme (WFP), and Ethiopian Airlines.

In addition to global donations of medical supplies, the Jack Ma Foundation and Alibaba Foundation have launched a number of global initiatives to support global medical communities in their fight against Covid-19. The Foundations established the Global MediXchange for Combating Covid-19 (GMCC) program for medical experts around the world to communicate seamlessly with each other and share their invaluable experience of fighting Covid-19. The Foundations have also published and distributed two handbooks, available in multiple languages and detailing learnings and best practices from the First and Second Affiliated Hospitals, Zhejiang University School of Medicine, for treating Covid-19 patients.

The Jack Ma Foundation is also funding research and development of Covid-19 vaccines and virus treatment options in China, at the Peter Doherty Institute for Infection and Immunity in Australia and at Columbia University in the U.S.

Supporting Small Businesses

Verizon has undertaken numerous efforts supporting small businesses, including:

Feeding Frontline Healthcare Workers in NYC—Verizon Business is supporting small business restaurants in New York City and providing healthcare workers on the frontlines with 1,200 daily meals at six hospitals across the city. The ordering and delivery process is managed by Grubhub, which donated its service to help this cause.

Pay It Forward Live is Verizon’s weekly streaming entertainment series in support of small businesses affected by COVID-19. Over the course of Pay It Forward Live, viewers are encouraged to do what they can to support local businesses in their own communities by shopping online, making a purchase in advance for when businesses reopen or ordering a meal. Verizon will also donate $10, up to $2.5 million, to support small businesses when the hashtag #PayitForwardLIVE is used. More information, along with a link to apply for grants, can be found here. The funds from Pay it Forward Live are part of Verizon’s combined $20 million donation to nonprofits directed at supporting students and healthcare first responders, including No Kid Hungry, the American Red Cross, the Center for Disaster Philanthropy (CDP) COVID-19 Response Fund, Direct Relief, and the COVID-19 Solidarity Response Fund in support of the World Health Organization (WHO)’s global response.

$2.5 million Donation to Local Initiatives Support Corporation’s (LISC) small business COVID-19 relief efforts. More information, along with a link to apply for grants, can be found here.

Verizon Up—Verizon is giving its customers another way to support small businesses by leveraging its customer loyalty program, Verizon Up, which will give members the ability to use their monthly reward for a Visa eGift card to use to support small businesses throughout April.

Coronavirus stock photo by Silver Wings SS/Shutterstock