By Rieva Lesonsky

15 Things Entrepreneurs Need to Know

1) Rolling in the Chips

Have you been getting replacement credit cards in the mail, even if your old ones haven’t expired yet? There’s a reason for that—and it affects small business owners.

In October all credit and debit cards will be embedded with smart chips. If your business isn’t prepared to accept these cards, you could be responsible for fraudulent card-present transactions that occur when customers are using chip cards.

The new liability standard is called EMV—stands for Europay, MasterCard and Visa—and is designed to reduce fraud, by enhancing the security already enabled by the traditional magnetic stripe on the back of the card, with the addition of a unique identifier for each transaction. Yet with the deadline approaching, “Small Business Adoption of EMV Technology,” a new research report commissioned by Intuit Inc. reveals only 42 percent of small businesses currently plan to make the switch.

That seems shortsighted to me. To help, you can pre-order the QuickBooks Mobile EMV Card Reader ($30) from Intuit. It’s easy to set up, small enough to carry and seamlessly integrates sales transactions within QuickBooks Online, as well as with QuickBooks Desktop using the QuickBooks GoPayment app. Additional EMV-compatible solutions for select versions of QuickBooks Desktop and QuickBooks Point of Sale will be released later this year.

The survey also reveals:

- 42 percent of small business owners didn’t know about the EMV liability shift deadline

- 57 percent the cost of a new terminal or reader is the top reason they’re not planning to upgrade to an EMV-compatible solution

- 85 percent of the business owners who don’t plan or are undecided about migrating to the new system don’t know about the financial and legal liabilities they will be responsible for this October

And if you think it doesn’t matter, that you’ll just accept cash and checks, think again. First, for 58 percent of small businesses, sales transactions are higher when customers pay with a credit card. Second, as I just wrote, not accepting credit cards will actually cost your small business money.

There’s more information and resources, including a step-by-step guide to EMV migration and quiz to test EMV business preparedness, at QuickBooks’ Small Business Center.

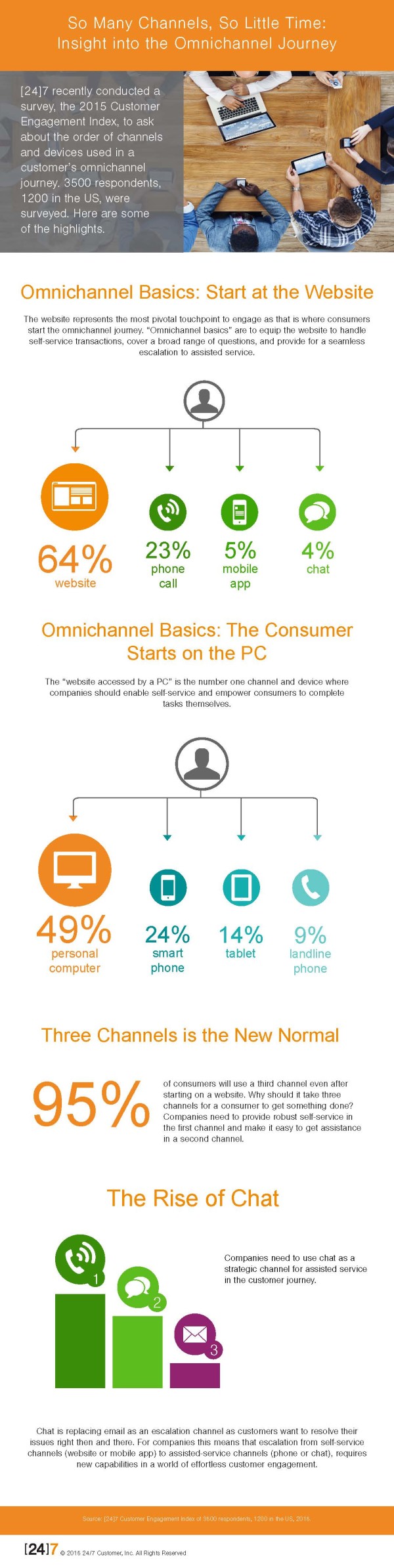

2) Customer Engagement

How do consumers prefer to engage with brands? The [24]7 Customer Engagement Index offers some interesting insights:

Your website is still the most important asset your brand has:

- 89 percent of consumers turn to a website within the first two channels

- 64 percent turn to a website first

- 49 percent use their PCs when they first interact with a brand

When there’s an issue almost all (95 percent) of consumers turn to a 3rd-party customer channel to solve inquiries or problems. And they don’t consider email as a viable channel to contact customer service. Surprisingly (to me anyway) for customer service assistance, customers prefer to make a phone call.

3) Inspiring Women Entrepreneurs

The Story Exchange recently released its first-ever Power List of women entrepreneurs. These women, ages 35 to 55, are leaders of successful, established, growing businesses.

Check out the website to learn how these women are excelling in their businesses—and making a difference.

4) Surveying Microbusinesses

Thumbtack has joined forces with Bloomberg to survey small businesses monthly, including, says Jon Lieber, Thumbtack’s chief Economist, “Many businesses…with few or no employees, that are often overlooked in other widely-tracked business surveys.”

The first survey shows a slow and steady recovery among America’s smallest businesses:

- There was a 25 percent reduction in businesses citing “uncertain economic conditions” as their number-one concern for the future

- Over 80 percent predict their revenues would increase over the next 3 months and that financial conditions would improve as well

Although the optimism was nationwide, businesses in the South are the most positive about the economy.

5) Online Communities Find Success

A new study from Manta and sponsored by Bank of America, reveals the vital role online communities play in helping small businesses succeed. According to the study, of the 30 percent of entrepreneurs who currently participate in professional online forums, 74 percent attribute their success to active involvement in these online communities. Within online communities, small business owners openly discuss business challenges, offer advice to colleagues, and benchmark best practices.

Of those using professional online communities, 26 percent participate in five or more. The topics the business owners are interested in include:

- Marketing (37 percent)

- Industry-specific topics (25 percent)

- Technology (16 percent)

- Customer acquisition (10 percent),

- Operations (4 percent)

- Leadership/HR (4 percent)

- Financing (3 percent)

One-quarter of small business owners active in these online communities get the most value from connecting with others in their own industries.

Want to increase your connections and influence online? Here are Manta’s 3 top tips to get the most out of online communities:

1. Use social networking to build in-person professional contacts.

2. Network outside of your industry. What are they saying about the future and how you can apply it to your industry?

3. Join forces and unite with other businesses, and offer a communal reward program.

6) Get Marketing Help

My friend John Espinoza has just launched a new marketing program expressly for small businesses. MyBrand combines big-agency talent with Digital Asset Management (DAM), and Brand Asset Management (BAM) so anyone can instantly create branded marketing collateral for print or web publishing.

Here’s how it works: MyBrand assesses your brand and develops a strategy for your company. Then you get access to custom branded marketing formats, developed by John’s team, who’ve worked on campaigns for Nestle, Hilton and Disney. All at a fraction of what it would cost to hire a traditional marketing or branding agency.

There’s no learning curve. MyBrand is an easy-to-use cloud-based platform so there’s no need to learn expensive design programs or coding.

At this time MyBrand is crowdfunding. If you go to the Indiegogo MyBrand page and give money, there are perks to be had. Check it out to find out more.

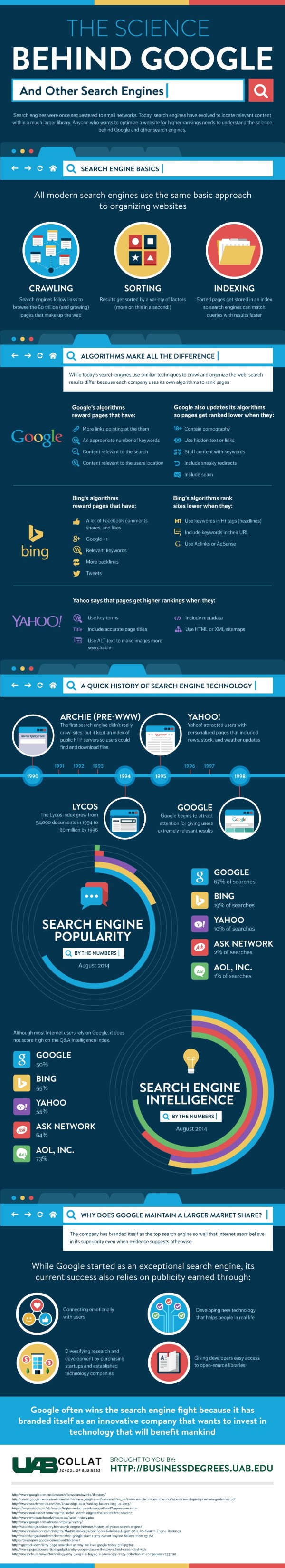

7) SEO Tips

Getting someone to professionally do search engine optimization (SEO) for your business website can get expensive quickly. Especially if you’re just starting out when advertising and marketing your business usually takes priority over worrying about how your website is doing according to Google.

Luckily there are a lot of SEO tricks that you can do yourself that Google will appreciate, and help you out in the rankings. How? Liam Barrett, an online marketing specialist from Boise, Idaho gives us the scoop.

So how does Google work and what are they looking for when it comes to your site? The infographic, from the University of Alabama at Birmingham’s Online Management Information Systems, shows us how Google, and other search engines work. Here’s how to start getting optimized:

Creating Content

Google is all about good content. When they index (scan) your site, they are looking for an up-to-date blog, with relevant topics in your niche.

So the first tip is to start regularly blogging, and create good content for your site. Let’s say you’re in the business of carpet cleaning. Conveying your expertise in the carpet cleaning industry on your website will help gain authority, and lead to a successful blog.

If you’re offering great tips, information, or news about carpet cleaning on your site, not only will you attract the right type of audience, but Google will also see that you’re obviously relevant in the carpet cleaning industry.

Guest Posting

Guest posting is almost a sub-subject for creating content because really that’s what you’re doing, just for other sites.

Guest posting is finding a great site, relevant to your niche (say carpet cleaning again), and providing them an article about something carpet cleaning related.

Why provide another site with content that you could easily put on your own? Because you get links back to your own site from a really good/authoritative site. There is no shame in mentioning a blog post that you previously made on your own site. Not only does this help build your own authority, but builds your business’s brand too.

An example would be if you wrote a guest post on a site like Stanley Steemer’s blog about how to properly shampoo a floor. You could discuss the best shampoos to use, and link to an article you wrote on your own site about “The Best Types of Shampoo to Use on Carpets”.

It’s important to keep in mind that you’re creating great, relevant content. Always think about the user’s experience first. If it doesn’t make sense to you, it won’t make sense to the user, or, importantly, to Google.

Getting Links

If you’re talking to someone not fully educated in the SEO world, they may tell you that links are dirty and bad, which in some cases can be true. The links they are referring to are spammy, non-relevant and gross, so of course Google doesn’t like them. The links that you are looking for are relevant, helpful and user friendly.

The purpose behind getting links is when Google indexes a site they evaluate the links on the page and where they are pointing. So, if you get a link pointing to your site on a very authoritative site, Google will see that this authoritative site is talking about your site.

For beginners, guest posting is probably the best way to go to build links because it’s straight forward, and a great way to get on high quality sites. Link building is something that can go very in-depth and can get complicated, so focusing on the user, and creating value for them should be your mission. Links will come naturally with that.

8) Social Philanthropy Role Model

Sage just launched the Sage Foundation, setting a great standard for “Corporate Compassionate Capitalism.” Each of Sage’s 14,000 employees will be able to contribute five days a year in work time to volunteer with any nonprofit they choose. The Sage Foundation will also give grants to create entrepreneurial opportunities for the young and disadvantaged within communities, as well as grants to match employee charitable donations and fundraising.

The Sage Foundation created a model of ‘2+2+2’: donating 2 percent of employee time each year (5 days), 2 percent of free cash flow and 2 of Sage’s smart technology products for any charity, social enterprise or non-profit organization. This is all driven by Sage’s desire to connect its customers, colleagues and communities within an integrated model. The Sage Foundation opens for business globally on October 1st.

Nonprofits will be able to apply for donated Sage One, Sage Life or X3 products, through the newly created donation program.

9) Courage

Hiscox, an insurance company for small businesses, just released a new digital docuseries, Courageous Leaders, featuring candid conversations with successful entrepreneurs about how they found the courage to embrace risk to succeed in life and business. It will be available exclusively across VOX media brands, including Vox.com, The Verge, Curbed and SB Nation. The series features entrepreneurs like Foursquare’s cofounder/CEO Dennis Crowley, Thrillist cofounder/CEO Ben Lerer and interior designer/TV personality Ross Cassidy.

Some of the themes discussed within the episodes include:

- How to find the courage to start a small business from nothing

- Flexibility: It’s great to have goals, but small business owners need to be able to learn from mistakes and let their plans be malleable to grow accordingly.

- Powering through rejection to find success.

This docuseries is part of Hiscox’s Encourage Courage brand platform. Hiscox’s previous original series, the award-winning scripted comedy Leap Year, received over 10 million views across two seasons.

10) Advice from a Banker

What do bankers want from small businesses? To get some advice from a banker, we turned to Quincy Miller, president of Business Banking for Citizens Bank. Miller offers his perspective, gained from working with many with business owners.

- Understand your operating cycle. Regardless of size, every business must deposit, monitor and manage cash; make payments; fund purchases; invest in their company; and receive payments. Reviewing and understanding each step in this cash flow cycle can help a company work more efficiently.

- Encourage faster payments. Can you provide an incentive or discount to customers or vendors to encourage them to pay faster? The sooner a payment is received, the sooner you can put that revenue to work for your company. Collections services like lockbox also can help post payments to your accounts more quickly.

- Consider remote deposits [Save Time + Money]. Some banks offer customers the opportunity to make remote check deposits from their mobile devices, sparing them trips to the branch. This allows companies to save time and to keep their workforce focused on operations—a benefit of particular importance for companies with only a few employees.

- Review your payroll process. If you pay your employees twice a month instead of every other week, you will be managing 24 payroll periods instead of 26 during the course of a year, making your company more efficient. Direct deposit of employees’ paychecks into their accounts can also create efficiencies.

- Evaluate real-time wires. If your small business is buying or selling overseas, real-time wires may be an option in lieu of visiting a bank branch. Some banks have the ability for customers to make ACH payments from their desk or office, which saves time and increases productivity.

- Manage outgoing payments in an advantageous manner. Banks can help establish relationships with credit card companies that can speed up payments from customers while giving additional timing or flexibility for repayment to settle your account.

- Look at opening a business credit card. A business credit card has many advantages, including the establishment of a clear separation of business and personal finances. In addition to providing clarity in the day-to-day operations of your business, this arrangement can eliminate confusion during tax preparations. If you have employees with company cards, consider solutions that allow you to monitor, track and control the way those cards are used.

- Have a Plan B. If you assume you can borrow funds to cover a cash shortfall, be sure to have a loan or line of credit set-up before the cash is actually needed. Waiting until the shortfall occurs leaves you in a ditch as most financial institutions will hesitate to lend money when your business is already in financial straits.

Cool Tools

Extending Facebook Reach

11) Hootsuite:

The decrease of organic reach on Facebook has led to several solutions from marketers. Here are a few new ones:

One of my favorite social media “helpers”, Hootsuite, just launched Hootsuite Ads, a new tool that turns high performing Facebook content into promoted posts.

While social advertising is a powerful channel, the ad creation and management process can be difficult and time consuming. Hootsuite Ads provides automation that radically simplifies this process. Users choose the primary business objective for each ad, and then receive automatic content and targeting suggestions from within their Hootsuite dashboard.

Hootsuite Ads helps users:

- Grow their business: Based on a user’s specific business objectives, Hootsuite matches organic content with a targeted Facebook audience in a measureable way.

- Create high performing ads: Automatically scans Facebook pages to find the best organic posts to amplify.

- Find the right audience: Automated targeting and bidding algorithms allow anyone to create highly targeted ads.

- Simplify ad management: Users can view clear results and manage all social posts and social ads, from one easy dashboard.

- Control ad spend: Intuitive reporting clarifies an ad’s results. Success is made visible and easily understandable with simple metrics that tie to an ad’s business goals.

12) Webs

Webs, the digital services business of Vistaprint, just announced the availability of social ads on its flagship social media marketing tool, Pagemodo. With this new tool, small businesses can easily design, target, publish and analyze ad campaigns on Facebook.

Most small businesses don’t have the graphic designers or advertising experts needed to create effective paid social media campaigns. With Pagemodo’s end-to-end solution, SMBs can design professional-looking ads, target the right audience, publish directly to Facebook and analyze the campaign results.

The new social ad tool, which is available to Pagemodo Pro and Agency subscribers, features:

- Simple, user-friendly interface

- Step-by-step Facebook ad creation

- Intuitive design tools for ads with company logos and custom images

- Collection of ad templates to highlight sales, events, promotions and more

- Extensive library of royalty-free images for ad usage

- Adherence to Facebook’s 20 percent text guidelines

- Simplified ad targeting on demographics, interests, connections and more

- Compatibility with Facebook desktop and mobile

- Ad analytics to help optimize strategy

13) Electronic Tipping

According to a recent survey, 78 percent of Americans carry less than $50 in cash and 10 percent leave home with no cash in their pockets at all. This can be awkward in today’s “tipping” society where one is expected to show appreciation to individuals for their service. Just the other day Leslie Moonves, the president and CEO of CBS was all over social media because he only had $100s and “couldn’t” tip the valet.

Too bad he didn’t have BRAVO, a new app that provides the ability to tip anyone, from anywhere directly from a smartphone in less than 10 seconds. BRAVO does not jeopardize your security, and charges a 2 percent transaction fee.

Here’s how it works: BRAVO allows users to locate the person they’d like to tip via GPS, Near-Field Communication, QR code or the individual’s BRAVO code, (which you get when registering). The user may choose to send any amount to the intended recipient, and the gratuity will be transferred directly into the recipient’s account.

Created by Hector and Maria Rodriguez-Luna, during its pilot program, BRAVO, 20 businesses reported an increase in tips for its employees, leading to increased employee morale and repeat business.

BRAVO says it’s different from other tipping apps because users can tip anonymously, and no personal information or photos of service professionals is collected.

To begin using BRAVO, users and service professionals may download the free app from the App Store for iPhone and Google Play for Android devices.

14) New from XERO

Xero, a provider of cloud accounting software for small businesses released a lot of new info this week, including:

- Solutions capitalizin on the value of Apple iOS mobility to deliver a more seamless customer experience.

- The release of its new Business Performance dashboard

- Extending the reach of its payroll services to new states

- Strategic partnerships with Bill.com, MINDBODY and Avalara

15) Enter & Win

Global food giant Mondelēz International just launched a Shopper Futures Initiative, which “partners startups and retailers in an effort to transform and improve the customer retail experience.”

The idea is for tech and mobile startups in the U.S. and Canada to apply for the program between now and June 27. After identifying top startups, the company will host a pitch day in August where nine final startups will be selected to partner with brands and retailers. The teams will then collaborate to design and execute a pilot in market within 90 days.

Companies participating in the program, include retailers, such as Albertsons/Safeway and QuickChek, plus some of Mondēlez’s most iconic brands like Oreo, Halls, Ritz and Cadbury.