9 Things Entrepreneurs Need to Know

By Rieva Lesonsky

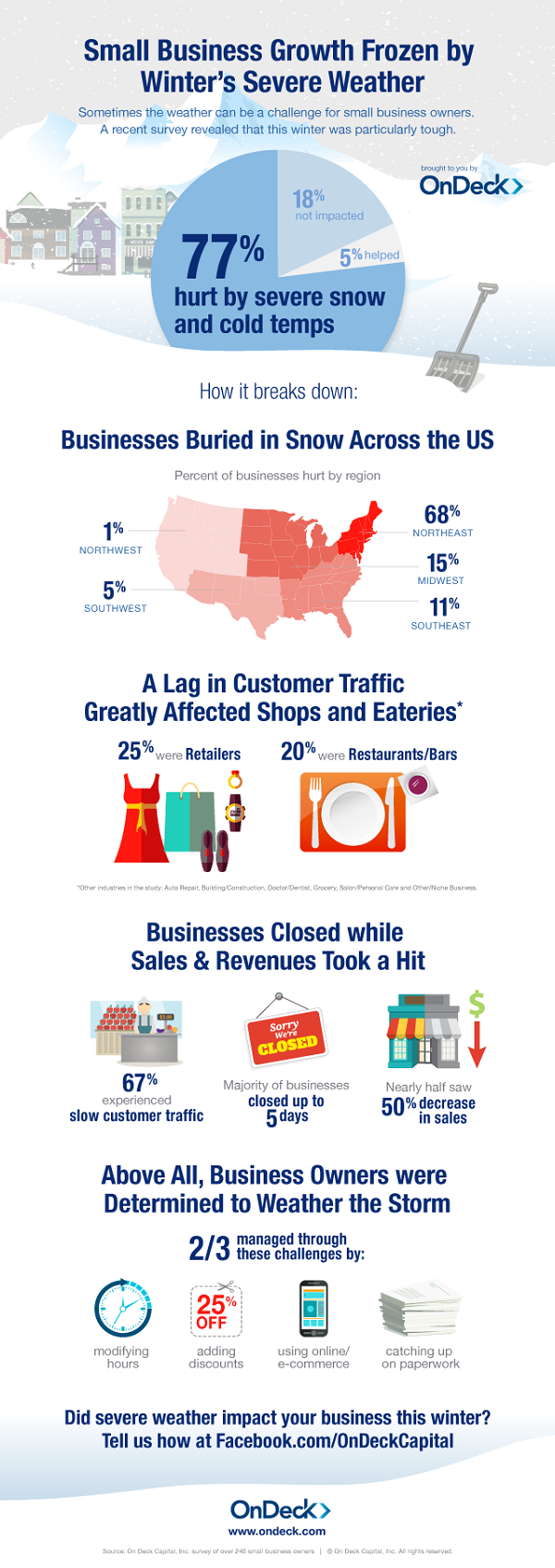

1) Winter Kills

Everyone who knows me knows I hate winter. That’s why I let New York for sunny southern California years ago. And right now, as spring hopefully is spreading across the country, a new study from On Deck Capital shows how deadly this winter actually was.

The quarterly Main Street Pulse Report shows that small businesses across the country were “negatively impacted by the extreme low temperatures and record snowfall this winter.” In fact, 77 percent of the businesses surveyed, particularly those in the Northeast where 68 percent were affected, had bad winters.

How bad was it?

- Customer traffic and sales were consistently down: 67 percent of businesses saw fewer customers than normal—and almost half lost 50 percent of their expected revenues.

- Nearly 73 percent of the businesses shut down for up to five days—and 14 percent were closed for 10 days or more.

- The businesses that suffered the most were retailers (25 percent negatively impacted) and restaurants and bars (20 percent).

But small business owners are tough. The study showed almost 70 percent got through the challenges by “modifying hours and services, engaging with their customers online and catching up on administrative work to identify growth opportunities.” More than 70 percent “either used or considered taking out financing to help bridge the weather-related gap.”

2) 5 “Celebrated” HR Practices Killing Employee Engagement

Most entrepreneurs acknowledge the success of their businesses depends, in part, on their people. But, when it comes to people management (annual performance reviews for example) many companies still use ineffective HR practices, causing a greater disconnect with their employees. According to Steve Parker, the head of Business Transformation at Achievers, which offers an “employee success platform”, only 30 percent of American workers are engaged at work, and you change that by “weeding these [bad practices] out of your HR strategy.”

Parker says business owners should be looking for new tactics—ones that increase engagement and eliminate strategies that are proving ineffective. Here are some of his suggestions:

Performance Management: Performance management is broken because we’re focusing on the weaknesses, not the positives. By creating a culture of recognition, you can celebrate employees doing the right things and praise them. At Achievers, we’re eliminating the “flight or fight” response that constructive feedback in traditional Performance Management evokes.

HR leaders need to be strength-finders. If an employee is not a good fit for the organization, be honest. Is this role the right one? If not, try to find a better fit.

Annual Employee Engagement Surveys: Annual or semi-annual employee engagement surveys disengage employees. At Achievers, we utilize our own platform feature called Engagement Pulse. Employees are asked every day how they feel about work. Anonymous responses provide managers with the ability to capture real-time results, not only one point in time, and compare teams’ daily trends against the pulse of the entire organization.

If levels have significantly dropped any given day or week, or alternatively if they’ve vastly improved, this can help uncover the underlying factors to increased engagement.

Employee Handbooks are dead: A traditional employee handbook exists to stop people from doing the wrong things. They should instead highlight company culture and behaviors that are praised and rewarded.

Recruiting: HR leaders focus on assessing potential employee skill and experience, when what they really need to find are people who are adaptable, resourceful, and great cultural fits. Hiring for employee experience and skill kills employee engagement when that hire doesn’t fit the company culture.

Reward Programs: Traditional reward programs are disengaging employees. They are delivered infrequently, aren’t timely, and disengage the rest of the workforce. Rewards need to be tied to a specific behavior so that the employee understands what they are being recognized for. Annual years of service awards reward an employee for sticking around, not for a job well done.

3) 5 Ways to Get Deals Done Faster

Abe Geiger, the CEO of Shake Law, says, “In a world where everything from massages to taxi rides are available on-demand, there is no bigger killer of deals than time. We’ve grown accustomed getting things done quickly—an impatience that extends to closing business transactions.”

Geiger says we need to make “agreements accessible, easy to edit, finalize, and sign” so we can remove much of the lag in deal making. And, he adds, “an increase in velocity means an increase in volume: You can generate more total deal flow when each individual deal takes less time.”

In other words, time truly is money. Geiger says, “A deal that languishes is a deal that dies,” and offers five tips for getting deals done faster:

Recognize that a deal can happen anytime, anywhere: Closing deals quickly means having the tools and resources you need at hand. Smartphone apps have streamlined email, calendars, presentations and spreadsheets so that we constantly carry a virtual office in our pockets. This is good, because some of our most productive business meetings happen at coffee shops, restaurants and bars.

Use apps that can help: With the plethora of apps available today, look for some that can help legally protect you and get the deal done right then and there. For example, with Shake, businesses can create, send and sign legally binding contracts on mobile devices. With our recent launch of Shake Pro, any company can take their standard set of forms, upload them via our web app, and deploy them to their workforce to fill-in and sign on the go.

Make items actionable immediately: When you think about a contract as a dynamic digital document instead of something written down on dead trees and filed away until there’s a dispute, it radically expands the possibilities of what a contract can do. Look for mobile apps that can automatically extract information like payment due dates and product delivery dates to sent “smart notifications” to the parties to the contract as a reminder of when an important date is coming up.

The contract is a blueprint for the relationship between parties for days, weeks, months or even years to come. Companies should be unlocking all of that information to use proactively instead of shelving it until it needs to be used defensively.

Get to the point: A lot of people balk at the idea of doing something like signing a contract on a mobile device. Shouldn’t I run it by my lawyer first? Doesn’t it make more sense to read it on a big screen, or even print it out? What these people don’t get, is that getting business done is about agreeing, not legalese. I see the small screen as a feature, not a limitation. It forces the parties to be concise, clear and to talk through any vagueness or misunderstanding on the spot. Technology is not just accelerating the speed of transactions; it’s also pushing the content of transaction documentation toward simplicity.

And if you need help, get it—quickly: Of course, there are times when it makes sense to apply the brakes and have an attorney or someone else review the documentation, especially for larger deals. Mobile is a big help in these cases too. You can instantly send a document for review and get a response on the go. You can work with templates that are pre-vetted by your company’s legal department. The lawyers can even specify limits on what types of changes you can make to the forms to make sure you don’t mess things up.

Making agreements accessible, easy to edit, finalize, and sign removes much of the lag in deal making. And an increase in velocity means an increase in volume: you can generate more total deal flow when each individual deal takes less time. In other words, time truly is money. Cutting the time between the inception and the closing of a deal will improve your bottom line.

4) 50 Shades of Write-Offs: Getting Creative During Tax Season

If you look at some of the findings in the recently released Xero to Sixty Report, from Xero, you might conclude small business owners are at their most creative when it comes to filling out their taxes. The report examines the relationships between small businesses and accountants, and their attitudes towards tax season. Among the key findings:

Strangest (and furriest) attempted write-offs: According to more than 35 percent of the accountants surveyed, clients wanted to write off pet-related items. And it’s not just dogs and cats. Apparently horses, and even a donkey, made the list. Coming in second place were more “adult” activities, such as strip clubs, gambling, alcohol and, yes, even breast enhancements.

The importance of the cloud: On a more serious note, the survey revealed accountants are trusted advisors to small businesses—and not just at tax time. According to the report, cloud technology solutions, such as file sharing and accounting applications, have made the relationship between accountants and small business owners more transparent. Eighty-five percent of accountants surveyed say these recent technology advances have allowed them to be more efficient.

Gas prices, tax policies and the minimum wage: The economy is still the top challenge in 2015 according to both small business owners (53 percent) and accountants (29 percent); however, factors such as gas prices and minimum wage were identified as variables that can significantly impact small businesses, for better or worse. Nearly half (48 percent) of small businesses saw a positive impact from recent lower gas prices and they are reinvesting these savings back into their business:

- 36 percent are investing in infrastructure

- 17 percent are hiring new employees

- 16 percent are expanding their business

Only 8 percent of small businesses are concerned about minimum wage increases in 2015, expressing more concern about new tax policies (14 percent), new technologies (11 percent) and raising capital (10 percent).

The Disconnect Between Small Businesses and Accountants: The report also reveals disparities between how small businesses and accountants want to communicate. Most accountants (70 percent) recommend their small business clients talk to them at least monthly, while only 45 percent of business owners currently do so. And, according to the survey, the number of accountants who believe small businesses should be talking to them weekly has risen from 22 percent in 2014 to 31 percent in 2015.

5) There’s an App for That

BYOD (Bring Your Own Device) is here to stay. According to Cisco, 90 While this means employees are never “away from the office”—up to 70 percent regularly check email on their smartphones outside of work hours, BYOD comes with its share of issues if not implemented properly.

But apparently there’s an app for that. From security issues to inadequate Wi-Fi, to here are some apps that can help you run a better business and some that help reduce some of the issues associated with BYOD:

SuperBeam from LiveQoS provides easy and fast file sharing between devices even without a Wi-Fi connection. The app uses Wi-Fi direct technology, NFC, QR codes or an existing Wi-Fi connection (if available) to allow users to send, receive and upload files or entire files of any size at lighting fast high speeds. Once devices are paired, users can share an unlimited number of files of any type and size, as long as the receiving device has enough space to store them. The app is great for anyone on the go, whether it be moving between business meetings, traveling internationally or just commuting to work.

LastPass is one of the top password managers. Since 85 percent of businesses allow employees to bring their own devices to work, employees are undoubtedly carrying around sensitive company information from those devices. It’s important that employees do everything they can to keep that information from being easily accessed if the device is lost or stolen. Passwords are a simple way to secure a BYOD device, and LastPass makes it easy to generate and store strong, unique passwords for every account and app on a device.

Divide allows you to easily and securely separate your personal data from your business data. The app creates a separate and encrypted desktop to be used for your business data. Using this in conjunction with a password manager helps keep your business data secure even if your phone goes missing.

NetSfere keeps you securely in touch with your team wherever you are. The cloud-based enterprise messaging service is a secure platform for internal communication and collaboration that can be used across multiple devices. Employees can safely communicate business information in real-time from whichever device they happen to be using. And NetSfere offers the ability to send SMS text messages even when users are out of Wi-Fi or cellular data range to guarantee seamless message delivery.

6) Who’s Afraid of the “Big, Bad” Internet?

A report from Rasmussen College on digital literacy in 2015 shows (surprisingly) that Millennials find the Internet “more frightening” than older Americans. About 37 percent of Millennials find the Internet “scary,” compared to about 24 percent of older Americans.

Overall, of those surveyed:

- 71 percent worry about computer viruses

- 68 percent worry someone is stealing their personal information online

- 35 percent don’t feel safe online, yet 26 percent use the same password on multiple sites

Another surprising stat: about 70 percent of Millennials have set their Facebook profile to private, compared to 35 percent of those aged 35 to 54.

7) 5-Step Leadership Checklist

Breakthroughs are what give leaders an edge, but they don’t just happen and even the most successful leaders can miss opportunities, says Amy Fox, the president, CEO and founder of Accelerated Business Results, a leader in innovative business learning solutions.

Fox says, “Successful and effective business leaders are defined by their ability to achieve breakthroughs, overcome obstacles and spur To help you get there, Fox says focus on these areas:

1. Reclaim Your Time: Simplify your list of goals and strategies, identify your “make or break” critical factors and enlist your team to relentlessly pursue them.

2. Map Your Process: You need to continually reevaluate your processes, focusing on the customer’s perspective, in order to find opportunities to improve.

3. Connect More with Employees: Participate in conversations with employees who are energetic and passionate. Doing this regularly not only makes employees feel valued, but helps you identify specific calls-to-action in your business.

4. Learn from Dissatisfied Clients: It’s important to actively pursue client feedback. This way, you’ll always know where you stand and be able to (sometimes) rebuild relationships.

5. Know When to Recharge and Reenergize: Encouragement, optimism and confidence are hallmarks of energized organizations. When they are running low for yourself or your team, it’s time to refuel. No matter how you choose to recharge, the key is to step back and provide the care needed to re-energize yourself or your team so you are primed for that next major breakthrough.

8) Getting Carded

Bento for Business, which provides financial solutions for small businesses, just launched a prepaid commercial MasterCard solution designed for small businesses that depend on employees to purchase supplies or services.

This can be a useful tool for small businesses that don’t qualify for a traditional business credit card. Instead of purchasing supplies yourself or having to reimburse employees for purchases they make with their personal credit cards, using the Bento MasterCard, which is a prepaid commercial card, offers convenience and spending controls.

Card benefits include:

- Anyone can qualify for the card and it doesn’t impact your personal credit, since the Bento accounts are prepaid debit cards and not credit cards.

- Setting up an account is easy—and the company says most applications are approved instantly.

- All balances are held in one centralized account, so you don’t need to keep updating amounts on each individual card. Limits and refill preferences only need to be set once.

- You can establish rules by employee, amount, time and category (i.e. gas card or supplies card, limited to weekday spending only).

- Bento cards can bear the employee’s name, but if that worries you, they can be enabled and disabled with just one click. Unauthorized transactions are declined automatically according to the rules set by you.

- Straightforward dashboards enable you to see everything in one place and quickly track expenses by place, employee, project, category and more. Simple invoices can be generated in seconds, and there is no longer a need for expense reports.

- Bento account data, which is accessible via any computer or mobile device, can be easily exported to QuickBooks or other accounting programs, making bookkeeping painless. By using tags, business and personal expenses can be separated easily at tax time.

9) Spring Cleaning

It seems like I’m writing a spring cleaning post every week—but that matches my vow (which I seem to be renewing weekly) to spring clean my office.

If you’re like me, The Neat Company has some suggestions of how we can get more organized this spring.

Clean out your inbox: Take the time to sort through your email, create folders to house client or customer-related threads, and unsubscribe from newsletters or wire services that you simply don’t use. Unroll.me is an ingenious solution that goes through your entire inbox, filters out every subscription and allows you to unsubscribe with one click.

Get rid of paper clutter: Technology was supposed to do away with paper, but if anything it seems to have produced even more. Nowhere is this truer than in an office. Unfortunately, there are some documents that simply cannot be thrown away but if they are stored digitally, they can be stowed and kept out of sight. The NeatConnect scanner (part of Neat Company’s Smart Organization System) is a great tool that small businesses can use to reduce the paper piles in their offices while using Neat’s innovative software (including cloud and mobile) to organize and work with those documents digitally.

Revisit your website and social media properties. For most companies, the first impression your potential clients and customers get is from your website or social media networks. An outdated website or inactive social media accounts can send the wrong message, so a routine check-in should be a priority. Use this opportunity to overhaul or update your website. Hootsuite is a popular social media management tool for updating and maintaining your company’s social media.

Rieva Lesonsky is CEO of GrowBiz Media, a media and custom content company focusing on small business and entrepreneurship. Email Rieva at rieva@smallbizdaily.com, follow her on Google+ and Twitter.com/Rieva. To get the scoop on business trends and sign up for Rieva’s free TrendCast reports.